This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features F&B companies views on mobile technology, the cashless culture and OpenTable's best bruch restaurants.

F&B and Mobile

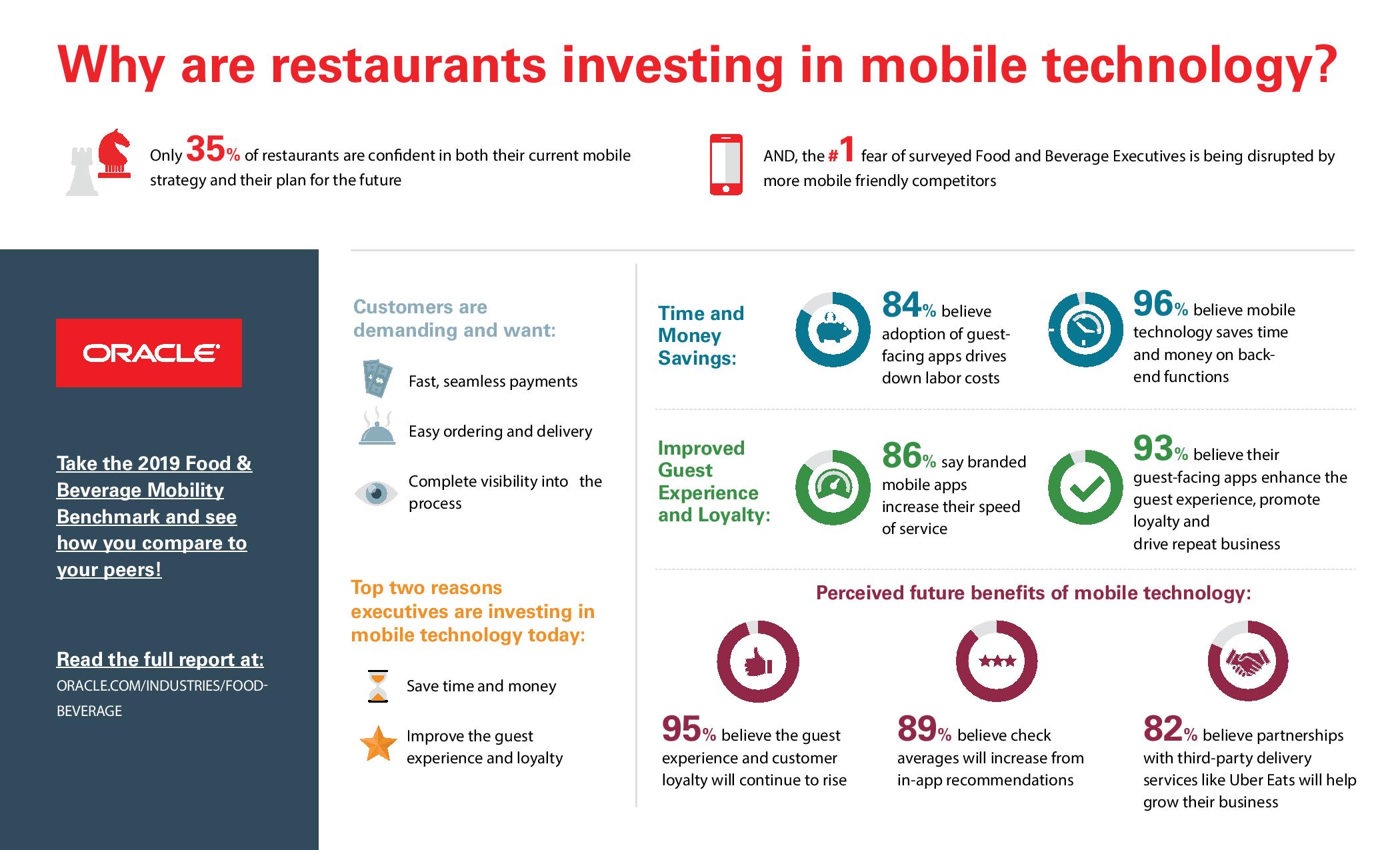

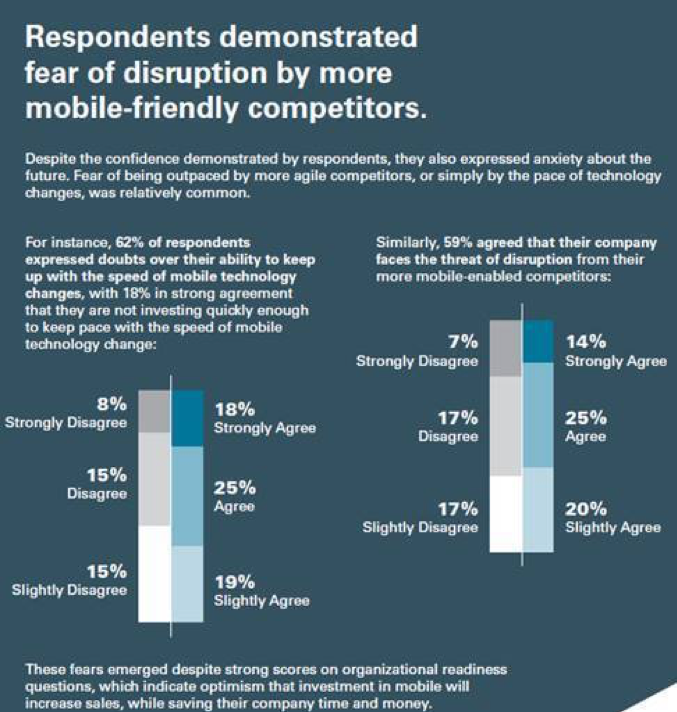

A recent survey of food and beverage leaders highlights that while a large percentage feel confident in their restaurant’s current use of mobile technology, only 48 percent feel prepared to capitalize on future innovations. Sixty-two percent of respondents expressed doubts over their ability to keep up with the speed of mobile technology changes. And more than half (59 percent) agreed that their company faces the threat of disruption from their more mobile-enabled competitors.

“The rise of mobile ordering and on-demand food delivery services are completely changing the restaurant and guest experience,” said Simon de Montfort Walker, senior vice president and general manager for Oracle Food and Beverage. “In order to remain relevant to a rapidly evolving audience, restaurants must act quickly to modernize their mobile strategy and offerings. Today, the experience a customer has ordering online or from a kiosk can be just as essential as if they were ordering in the store.

The study findings point to a clear and urgent need for restaurants to embrace the right mobile and back-end technology to drive higher ticket value, turn tables faster and enable more cross and upsell. In addition, the findings highlight the need to embrace mobile technology to avoid being outpaced by the competition, help cut labor costs and improve the guest experience – all critical components to revenue growth.

Cutting Costs, Saving Time Equals Increased Revenues

Restauranteurs are investing in mobile technology to cut costs and save time in areas such as hiring less serving staff but more runners, keeping a close eye on stock levels to avoid over-ordering and waste, and the ability to quickly change the menu and offer specials when there is an over-stock of inventory.

84 percent of food and beverage executives believe the adoption of guest-facing apps drives down labor costs

96 percent agree, with 40 percent strongly agreeing, that expanded mobile inventory management will drive time and money savings

Improving Loyalty and the Dining Experience

Today’s foodies are satiated with choices. In addition to great food, what drives their loyalty is easy ordering and delivery, fast, seamless payments, and a personalized experience.

86 percent of operators say branded mobile apps increase their speed of service and therefore revenue

93 percent believe their guest-facing apps enhance the guest experience, promote loyalty and drive repeat business

Perceived Future Benefits of Mobile Technology

Restaurants are already using mobile devices for table reservations, taking orders, and processing payments, but what value do restauranteurs believe will come from future mobile innovations?

82 percent believe partnerships with third-party delivery services like Uber Eats and GrubHub will help grow their business

89 percent believe check averages will increase thanks to in-app recommendations

95 percent believe the guest experience and customer loyalty will continue to improve

The Road Ahead

While most organizations rated themselves as highly able to meet new consumer demands, an undercurrent of anxiety about the future was also apparent with only 48 percent of respondents reporting that they have the tools they need to meet the mobile demands of tomorrow. The mobility study findings show a clear path for restaurateurs including applying mobile innovation to broader areas such as inventory efficiency, getting new customers in the door, serving them more efficiently, and keeping them coming back.

For this survey, Oracle queried 279 leaders in the food and beverage industry who use mobile technology in their organizations during the summer of 2018. 45 percent of those surveyed were from full-service restaurants, 24 percent from fast casual and 23 percent from quick service. Seventy-one percent of respondents are director level or higher, with 45 percent hailing from companies that generate more than $500M in annual revenue.

To learn more, click here.

Restaurant Rebound

The restaurant industry's sales rebounded solidly during March after stumbling the previous month. Same-store sales growth was 1.2 percent in March and 1.0 percent for the first quarter of 2019. The industry is going through its strongest period of sales expansion since 2015, with four consecutive quarters of positive same-store sales growth, according to TDn2K's Black Box Intelligence™. However, chain restaurants continue to struggle with declining guest counts. Same-store traffic was -1.8 percent during March.

Restaurant guests have many options when it comes to buying food away from home. This means each guest interaction is vital for restaurant brands to develop loyal guests that will help offset this waning traffic trend. But are restaurants delighting their guests and meeting their expectations?

White Box Social Intelligence™ data reveals sentiment has indeed been increasing for restaurant guests in recent months. Guest sentiment based on chain restaurant food became more positive during each month in the first quarter compared with March of 2018. The same is true for guest sentiment based on restaurant service. This is especially important since TDn2K research continues to show that service is a key differentiator for top performing brands based on sales growth. A common characteristic of these top performers in recent years has been delivering an experience that is driving higher service sentiment scores.

Although intent to return positive sentiment is declining slightly year over year, the overall values remain extremely high.

Connecting the Dots

What food items do guests of top performing restaurant brands love? What food offerings have the highest guest sentiment among the brands with the largest same-store sales growth during the first quarter of 2019?

In the case of guests of top performing limited-service brands (those in quick service and fast casual), the terms with the highest net sentiment during March were the following: sandwich, BBQ, salad, fries and chicken. Most of these terms typically come to mind when thinking about limited-service restaurants. But there are guests of these segments that are looking for healthier options. Top performing brands in these segments are providing craveable salad options as a way to attract guests and drive sales.

In the case of full-service brands (casual dining, family dining, upscale casual and fine dining), the food terms with the highest guest sentiment during March were the following: sauces, desserts, steaks, parmesan and avocado. It is interesting that in the case of full service, the terms that get the highest positive sentiment were mainly ingredients versus meals. The details such as the sauce or a topping included in a dish can make all the difference in delighting the guest. Additionally, once guests have decided to sit down at a full-service restaurant and spend a little more time and money, desserts are enhancing the experience and can be powerful drivers of positive sentiment.

Top and Bottom DMAs

March once again proved Orlando, FL has the restaurant guests with the most positive sentiment among the largest metropolitan areas in the country. Orlando topped the list with the most positive net sentiment based on restaurant food, beverages, service, ambiance and value.

As has been the case in recent months, Los Angeles again emerged as having guests the least satisfied with their chain restaurant experiences. During March, this market had the lowest net sentiment based on service, beverages and value. Raleigh is also frequently on the list of guests with lowest restaurant sentiment. During March, guests in this market had the lowest sentiment regarding restaurant ambiance, food and their intent to return to the brands they mentioned during the month.

Best and Worst Regions

The relative strength of chain restaurants can be perceived not only at the national level, but throughout the country as well. All eleven regions of the country tracked by TDn2K reported positive same-store sales during March. This is something that has only happened four times in the last three years, all of them within the last twelve months.

As could be expected, guest sentiment is also positive in all regions of the country. For the fourth time in the last five months, over 50 percent of all restaurant online mentions and reviews were positive in each of the eleven regions.

Florida not only has the market with the highest sentiment on multiple restaurant attributes, it was also the region with the most positive sentiment overall during March. It was the only region in which over 60 percent of all mentions and reviews were positive. The Mountain Plains and Western region rounded up the list of the most positive regions during March.

The regions with the least positive restaurant sentiment during March were the Southwest, New England, and New York-New Jersey. The last two are frequent inclusions in the list of least positive sentiment each month.

Restaurant Technology Report: Empowering Diners

Hospitality Technology released its 21st annual Restaurant Technology Study, titled, “Exponential Digital Drives Quantum Convenience.” For more than two decades, Hospitality Technology has charted the budgets, business drivers and investment plans of restaurant companies across segments and brand sizes. The study has chronicled the growth of restaurant IT over a course where the pace of change and technological advancement has been exponential.

Data from previous reports shows that in the not-far-distant past, the key charge for IT deployments was to reduce operating costs and increase efficiency. With that operational focus, in 2008, casual dining establishments were leading in technology innovation, with 43 percent saying they led the competition compared to 32 percent of QSRs that claimed to be leaders. In 2019, the quick service space includes fast casual concepts. Combined, the vast majority (93 percent) claim to feel they lead in innovation. This isn’t necessarily false pride – as the more successful a brand is, the more likely they have been referred to as “technology companies that serve food.”

The 2019 study reveals that restaurants are placing hyper-focus on empowering diners with service options. Through illustrative and written analysis the report charts the budgets, strategy and investments of restaurant technology from what happened in 2018 to what is planned for 2019.

Key findings include:

- Restaurants are planning hardware upgrades with the largest portion of IT budgets being allocated here (23 percent). A telling byproduct of the fervor for delivery options is that the second greatest amount of IT spend will go to third party providers (21 percent).

- As a strategic goal for technology, engaging with third-party delivery providers is a priority for 12 percent of overall respondents, but restaurants that consider themselves innovators in digital customer engagement put higher urgency here with 33 percent naming it top goal.

- The drive for providing new service and delivery options for diners crystallizes in investment plans for 2019. The top six investment areas for restaurant innovation is dominated by providing guests with personalized experiences. These include: third party delivery integration (48 percent), mobile payments (47 percent), digital ordering (45 percent), tableside ordering (34 percent), predictive analytics (34 percent) and interactive kiosks (32 percent).

- These investment plans are mirrored in software rollout plans. The focus will be on digital ordering software upgrades and changes with 59 percent of restaurants putting IT dollars here. This is tied with mobile payments which sees 25 percent of restaurants adding the functionality for the first time, 26 percent making enhancements and another 8 percent changing suppliers.

- As goes software, so goes hardware. Looking at installation plans for hardware POS terminals, kiosks and tablets take the lion’s share of investment in 2019. Providing guests with the option to self-serve has driven more than a quarter of restaurants to plan to add kiosks for the first time and 19 percent of restaurants are adding tableside tablets for payment.

- The leaders in the restaurant industry are proving that the focus on digital will be the source of growth. These digital components will be bolstered by data on both the customer side – to understand what guests want, where and how, and on the business side – to monitor, react and predict with attention on KPIs.

To download the 2019 Restaurant Technology Study,: click here.

Understanding the Cashless Culture

In Cashless Culture: the Marketer’s Guide to the Emerging Cashless Consumer, consumers grapple with the future of cash, cards, mobile, and everything in between. The surprising findings uncovered significant insights for the grocery, retail and restaurant categories in particular.

The biggest takeaway? We have a long way to go before we give up our cash completely. And yet most of us seem resigned to eventual digital domination: Over 50 percent of those surveyed anticipate paying for goods and services via fingerprint scanning or facial recognition within ten years.

Among the study’s compelling data points:

Cash and Cards Are Far From Dead

- 76 percent still carry cash daily

- 55 percent hate the idea of life without cash

We’re Still New at Mobile Payments, But Younger Consumers are Leading the Way

- 58 percent of those using mobile payments have only started in the past year

- 45 percent of those over 40 have never used mobile payments; while 22 percent of those under 40 use it daily

Significant Barriers to Going Cashless Remain:

- 45 percent say there is no reason to use mobile payments

- 63 percent say clear and consistent visual cues around mobile payment options are needed at P.O.P.

A Little Loyalty Goes a Long Way

As most businesses want to collect more and more data from customers to benefit their marketing efforts, they may be surprised to learn—just in time for national “Get to Know Your Customer Day” on April 18, 2019—that most customers actually don’t want to get that chummy. In fact, according to a new U.S. survey conducted online by The Harris Poll on behalf of Wilbur, a new, ultra-simple loyalty program designed by Smart Transaction Systems, most Americans (71 percent) would be less likely to join a loyalty rewards program that collects personal information (e.g., address, account information), with 27 percent saying they would be much less likely.

In addition, most Americans (58 percent) are also less likely to join a customer loyalty program that requires them to download an app to access the benefits, with 26 percent saying they would be much less likely.

“These survey results prove that U.S. consumers are becoming much more selective about the loyalty programs they join and, I believe, are ultimately more loyal to brands that respect their personal privacy,” said Ray Clopton, President and CEO of Wilbur and Smart Transaction Systems. “It is really important for businesses to pay attention to what their customers want—especially when developing a loyalty program—and I think these results could not be timelier given that we’re about to celebrate ‘Get to Know Your Customer Day.’ Yes, businesses should get to know their customers—but as people. Not as a slice of a database or a spreadsheet column.”

The survey also found that a majority of Americans (76 percent) are more likely to join a customer loyalty program that collects only their name and phone number, with 32 percent responding they would be much more likely to join. Americans also said they were more likely to join a customer loyalty program that does not require them to carry a physical card (79 percent), with 34 percent saying they would be much more likely to join.

“What these results tell us is that customers don’t want to join a loyalty program that asks for too much data or requires them to carry another card in their wallet or download another app on their smartphone,” Clopton says. “We have been hearing this from customers for years, which is what inspired the creation of Wilbur and how it works. But it feels official now that a reputable research company like The Harris Poll has validated our assumptions and informal research.”

Wilbur is a privacy-friendly, super simple loyalty program designed for busy business owners who don’t have extra time to manage a loyalty program, and customers who don’t want to fill out another form, carry another card or download another app. The program only collects customers’ first name and phone number, and only texts them when they have earned or redeemed rewards.

This survey was conducted online within the United States by The Harris Poll on behalf of Wilbur from April 4-8, 2019 among 2,003 U.S. adults ages 18 and older. T

Best Brunch

OpenTable, the world's leading provider of online restaurant reservations and part of Booking Holdings, Inc. (NASDAQ: BKNG), today released its annual list of the 100 Best Brunch Restaurants in America for 2019. OpenTable data shows that 81 percent of diners book their Mother’s Day reservations two weeks in advance, so the list comes at the perfect time to help diners find the best brunch eatery to celebrate the mother figure in their lives. Featuring restaurants coast-to-coast, across 24 states and Washington, D.C., the list is a comprehensive look at the best brunch spots in the country. The Best Brunch Restaurants in America list was culled from more than 12 million verified diner reviews of over 30,000 restaurants in 50 states and Washington, D.C.

From restaurants with magnificent views like Geoffrey's Restaurant in Malibu, Calif., to brunch institutions like Sadelle’s in New York, to acclaimed eateries like Somerset in Chicago, the Best Brunch Restaurants list features a wide variety of restaurants. California is the most recognized state on the list with 16 restaurants honored, followed by New York with 12 winning restaurants and Illinois and Pennsylvania with eight each. Florida, Texas and Washington, D.C. each boast seven winning restaurants and Louisiana claims five honorees.

The annual list comes on the heels of OpenTable’s national #DiningMode campaign, a challenge to diners to set aside their phones while dining with mom and connect with those around them this Mother’s Day. Diners are now encouraged to give moms the gift of being truly present at a celebratory brunch at any of this year's winning restaurants making honoring the mom in your life easy and more rewarding.

“On Mother's Day 2018, we seated more diners than any other day that year and recognize that celebrating mom is a priority for our diners," said Caroline Potter, Chief Dining Officer at OpenTable. “The honorees on this year’s best brunch list are creating experiences that will dazzle her and make embracing our #DiningMode challenge a snap, with sublime drinks and dishes and friendly service. You won’t be tempted to pick up your phone on May 12 at any of these spots.”

The 100 Best Brunch Restaurants list is generated solely from diner reviews collected between March 1, 2018 and February 28, 2019. All restaurants with a minimum "overall" score and number of qualifying reviews were included for consideration. The overall score is made up of unique data points, such as overall diner rating, user klout, total number of reviews and regional overall rating. Qualifying restaurants were then scored and sorted according to the sum of tags for which "brunch" was selected as a special feature.

Based on this methodology, the 100 Best Brunch Restaurants in America for 2019 according to OpenTable diners, are as follows (in alphabetical order):

100 Best Brunch Restaurants in America for 2019

Atchafalaya Restaurant – New Orleans, Louisiana

Balthazar – New York, New York

Bartolotta's Lake Park Bistro – Milwaukee, Wisconsin

Beachcomber Cafe – Crystal Cove – Newport Coast, California

Brennan's – New Orleans, Louisiana

Brennan’s of Houston – Houston, Texas

Bristol Seafood Grill – Multiple Locations

The Butcher, The Baker, The Cappuccino Maker – West Hollywood, California

Bud & Marilyn's – Philadelphia, Pennsylvania

Café Ba-Ba-Reeba – Chicago, Illinois

Cafe Fiorello – New York, New York

Cafe Luxembourg – New York, New York

Cafe Monte – Charlotte, North Carolina

Cappy's Restaurant – San Antonio, Texas

Carmine's – 44th Street – New York, New York

Catch LA – West Hollywood, California

Chart House Restaurant – Weehawken, New Jersey

Chez Zee – Austin, Texas

Cookshop – New York, New York

The Copper Hen – Minneapolis, Minnesota

The Dandelion – Philadelphia, Pennsylvania

The Dining Room at Salish Lodge & Spa – Snoqualmie, Washington

Duke's – Huntington Beach, California

Emmaline – Houston, Texas

Farmers & Distillers – Washington, D.C.

Farmers Fishers Bakers – Washington, D.C.

Farmhouse at Roger’s Gardens – Corona Del Mar, California

Founding Farmers – Multiple Locations

The Gage – Chicago, Illinois

Gandy Dancer – Ann Arbor, Michigan

Geoffrey's Restaurant – Malibu, California

Gertrude's – Baltimore, Maryland

Giada – The Cromwell – Las Vegas, Nevada

Grace's – Houston, Texas

The Grand Marlin of Pensacola Beach – Pensacola, Florida

Great Maple – San Diego, California

Green Valley Grill – Greensboro, North Carolina

The Hamilton – Washington, D.C.

The Hampton Social – River North – Chicago, Illinois

Harbor House – Milwaukee, Wisconsin

Hell's Kitchen – Caesars Palace Las Vegas – Las Vegas, Nevada

The Henry – Phoenix, Arizona

HEXX kitchen + bar – Las Vegas, Nevada

Ida Claire – Addison, Texas

The Ivy – West Hollywood, California

Jake's Del Mar – Del Mar, California

Kyle G's Prime Seafood – Jensen Beach, Florida

Lafayette – New York, New York

Lake Elmo Inn – Lake Elmo, Minnesota

Le Diplomate – Washington, D.C.

Le Moo – Louisville, Kentucky

Lindey's – Columbus, Ohio

Little Goat – Chicago, Illinois

Lola Seattle – Seattle, Washington

Louie Bossi Ristorante – Fort Lauderdale, Florida

The Love – Philadelphia, Pennsylvania

Maggiano's – South Coast Plaza – Costa Mesa, California

Mama's Fish House – Paia, Hawaii

Mere Bulles – Brentwood, Tennessee

Mon Ami Gabi – Las Vegas, Nevada

Muriel's Jackson Square – New Orleans, Louisiana

Oxford Exchange – Tampa, Florida

Palace – Miami Beach, Florida

Palace Café – New Orleans, Louisiana

Parc – Philadelphia, Pennsylvania

Perch LA – Los Angeles, California

Pier W – Cleveland, Ohio

Poor Calvin's – Atlanta, Georgia

Print Works Bistro – Greensboro, North Carolina

The Rotunda at Neiman Marcus – San Francisco, California

Sadelle’s – New York, New York

Sarabeth's Park Avenue South – New York, New York

Shaw's Crab House – Chicago, Illinois

The Smith – Multiple Locations

Somerset – Chicago, Illinois

Spencer's Restaurant – Palm Springs, California

Stanford Grill – Columbia, Maryland

Succotash – Penn Quarter DC – Washington, D.C.

Summer House Santa Monica – Chicago, Illinois

Suraya – Philadelphia, Pennsylvania

Talula’s Garden – Philadelphia, Pennsylvania

Tavern on the Green – New York, New York

Terrain Garden Cafe – Glen Mills, Pennsylvania

The Tropicale – Palm Springs, California

Top of the Hub – Boston , Massachusetts

Tower Oaks Lodge – Rockville, Maryland

Town – San Carlos, California

Tupelo Honey – Downtown Asheville – Asheville, North Carolina

Ulele – Tampa, Florida

Unconventional Diner – Washington, D.C.

Upland – New York, New York

Whiskey Cake – Plano, Texas

White Dog Cafe – Wayne, Pennsylvania

Willa Jean – New Orleans, Louisiana

X2O Xaviars on the Hudson – Yonkers, New York

Yank Sing – Rincon Center – San Francisco, California

The complete list may also be viewed here.

MRM Research Roundup: End-of-April 2019 Edition posted first on happyhourspecialsyum.blogspot.com

No comments:

Post a Comment