Monday 30 April 2018

Ten Best Wage and Hour Practices for Restaurant Employers

With all the recent focus on pay equity and alleged gender-based disparities in compensation practices, restaurant employers should be aware that in the restaurant industry, the most important focus to avoid litigation should be on wage and hour practices. This is not to say that there is no need to always keep an eye on compensation practices from a gender equity perspective, but it is to say that there is far more wage and hour litigation in the restaurant industry than there is pay equity litigation, and it most often comes in the form of FLSA collective actions or class actions under state wage and hour law, which brings with it the higher potential exposure and cost of defense associated with class litigation.

Thus, the following best wage and hour practices are offered for consideration to stay in the restaurant, and out of court.

- Never forget that there is no federal preemption of state or local wage and hour laws. A large number of states (over half) now have state minimum wage requirements that exceed the federal minimum wage rate of $7.25/hour. Moreover, in the past several years quite a few cities and counties have passed local minimum wage requirements that are significantly higher than the FLSA. There is no substitute for carefully considering whether your restaurant is located in a state or locality that has a higher minimum wage rate that applies to your establishment.

- If you have tipped employees, best practice rule number 1 also applies to tip credit provisions. The current maximum tip credit under the FLSA is $5.12/hour. Many state and local minimum wage laws have higher minimum wage requirements and/or lower tip credit maximums per hour. Some even prohibit a tip credit of any amount. Thus, careful consideration of state and local wage and hour laws concerning tip credits is critical.

- Speaking of tip credits, understand that the FLSA and most state and local minimum wage laws place several conditions on the taking of a tip credit. Among these are providing advance notice to tipped employees that a tip credit will be applied, the amount of the tip credit that will be applied, that sufficient tip income must be received to at least cover the amount of the tip credit, and whether tips must be shared or pooled with other customarily tipped employees.

- Be aware of the applicable overtime requirements. The FLSA generally requires overtime pay for hours exceeding 40 in the work week. Some state laws impose various forms of daily overtime requirements.

- Utilize a time keeping system that accurately tracks and records all hours worked and use those records for payroll purposes.

- Prohibit all forms of working “off the clock.” If an employee is working, they must be clocked-in so they can be paid for that time. Consider including a daily or weekly certification in your time keeping system where each employee certifies that they have reviewed and confirmed that they have entered all their working time and they have not performed any work “off the clock.”

- Don’t overreach by classifying too many managers or assistant managers in the restaurant as “exempt” from the minimum wage and overtime requirements of the FLSA and state overtime requirements. There are many variables that factor into exempt classifications, including the number of employees in the restaurant, hours of operation, overlap between managers, etc. This issue requires careful consideration of your unique factors in each restaurant along with competent legal advice.

- Don’t forget about meal and rest breaks. The FLSA does not mandate that they be provided, but many state laws do. In addition, the FLSA does regulate whether break time must be paid when breaks are provided. Generally, the FLSA requires that in order for a meal break to be excluded from hours worked, it must be 30 or more minutes in duration, not interrupted, and the employee must be completely relieved from job duties.

- The restaurant industry is a popular place for teens to get their first job. Thus, if you hire employees under the age of 18 years, remember that the FLSA includes a host of child labor restrictions, and most state wage and hour laws include child labor regulations that are even more restrictive than the FLSA. In general, the FLSA places strict limits on the hours that may be worked by 14- and 15-year old employees, and limits the occupations in which such employees can be lawfully employed. It also has certain hazardous occupation restrictions that apply to all employees under the age of 18 and prohibit the use of certain equipment deemed hazardous.

- Consider providing an easy means for employees to raise questions or concerns about their paychecks. This can be as simple as adding an automated message to each pay stub that encourages employees to carefully review the information provided and call a designated telephone number if there are questions or concerns. Answering questions and resolving concerns internally is almost always easier, quicker and cheaper than responding to government agency investigations and/or attorney demand letters.

Remember, wage and hour compliance can be a tedious task, but it sure beats defending class or collective action litigation. The FLSA allows recovery of back wages and an equal amount in liquidated damages, plus costs and attorneys’ fees, looking back for either a two or three-year period. Most state wage and hour laws provide for similar recovery, but some allow for such recovery looking back for as many as five and six years. That makes ensuring wage and hour compliance up front the better option every time.

Ten Best Wage and Hour Practices for Restaurant Employers posted first on happyhourspecialsyum.blogspot.com

Friday 27 April 2018

Five Ways Restaurants Can Prepare for Summer

The last of the snow has finally melted away and the days are turning warmer, which means summer is just around the corner. For business owners, particularly restaurants, it’s time to start preparing for this busy season.

Longer days bring bigger crowds enjoying leisurely meals; and those bigger crowds present an opportunity for restaurants to attract new patrons. If you want to capture new customers and boost your revenue this summer, now is the time to start preparing. Not sure where to start? Here are five things – from marketing your establishment’s offerings to payment technologies – you can do to ensure you’re summer ready:

Get the Word Out

Summer can be a make-or-break time for many restaurants, so it’s important to get the word out as early as possible. There’s no better avenue than social media — especially Instagram.

As food pictures continue to dominate the Internet, you should not only share your own meals on your restaurant’s Facebook and Instagram accounts, but also encourage customers to do the same. According to research by Zizzi, 18-35-year-olds spend the equivalent of five days each year looking at pictures of food on Instagram; 30 percent said they’d avoid a restaurant if they had a bad Instagram page. Another tip? Seek out coverage from popular, local food-based Instagram accounts — see if they’ll feature some of your finest and most photogenic meals/cocktails.

There are countless other small tasks that will help to market your restaurant or make you more easily discoverable. Consider registering your establishment on Apple Maps to increase your chances of being found in relevant searches. Also try to make your Yelp presence a positive one.

Get Your Staff Ready

Sometimes, a seasonal rush means hiring new staff — for restaurants in vacation areas, it could even mean hiring an entirely new staff. However you find your new summer employees, it’s important to start looking early to make sure you’re set well ahead of time (… after all, the proactive early job seekers may be the best employees.) But don’t forget: equally important as finding good employees is planning and preparing employee training with your restaurant processes and equipment.

Optimize Your Technology

Wait time plays a big role in customer satisfaction. Restaurants now have new technology options that can vastly speed up checkout, and the time to explore this tech is now, before the busy season hits.

Pay at the table, for instance, is growing in popularity throughout the US, and can massively cut down on restaurants’ payment processing times. Ninety-three percent of restaurants usually have some wait time, and at the busiest times customers typically wait 30 minutes. Using pay at the table to turn over tables faster will make a huge difference in those times — it could cut them by nearly 20 percent.

You also need to have intuitive, easy-to-use tech, too, so that new summer employees can quickly familiarize themselves with it. Wait staff should concern themselves with remembering customer orders, not remembering how to enter them into your system.

Move Outdoors

Many restaurants have an outdoor space that can hold additional customers when the weather’s nice. If you don’t have an outdoor space, there’s other ways to move beyond your four walls: pop-up shops, food festivals, food trucks and more are all great ways to expose your brand to new customers. And if you’re using mobile technology, it not only can enable pay at the table that makes outdoor dining easier, it can enable remote checkout in areas like food trucks, too.

Prepare the Summer Touches

Whether it means adding gazpacho and refreshing cocktails to appease seasonal tastes, or opening windows to evoke a patio feel, it’s important to make sure you’re ready to appeal to customers’ season-specific mindsets.

Keep your menu fresh and interesting by updating it with summer-inspired specials. Make sure you have your plans laid out for both food and décor. Determine who your distributors will be, and be ready to make the changes over the coming months.

So while it may still be cold, it’s time to prepare for the warmer weather. Get started soon, and be well on your way to a very prosperous summer.

Five Ways Restaurants Can Prepare for Summer posted first on happyhourspecialsyum.blogspot.com

Thursday 26 April 2018

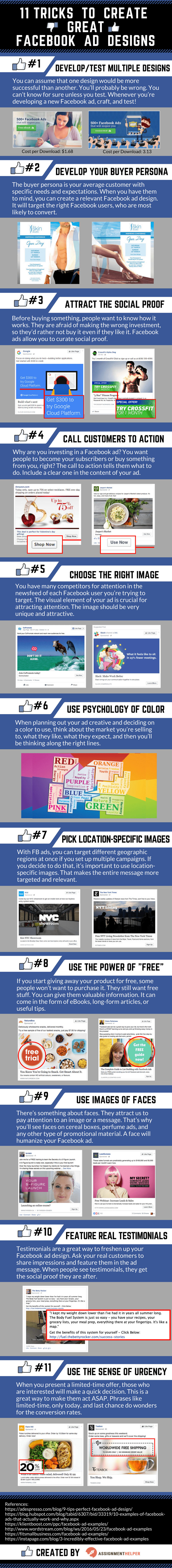

11 Tricks to Create Great Facebook Ad Designs (Infographic)

Whether your restaurant is a healthy eatery, fast food, fast casual, a gastropub, or high-end, it’s safe to say that your target audience uses Facebook. The ability of Facebook to reach specific audiences, build awareness, and attract new customers is undeniable, so more and more restaurants use Facebook ads. They’re cheaper than traditional advertising and can significantly increase your reach.

For restaurants, marketing is especially important because without meeting promotion needs, one can fail even with the best food in the world. Remember, your marketing needs should be just as good as food, ambiance and customer service.

Here are some of the stats to illustrate the increasing role of Facebook marketing for restaurants:

- Almost 50 percent of people search Facebook to locate local restaurants

- 75 percent of online consumers have reported using Facebook to decide on what restaurant to eat at

Impressive, right? The argument for your restaurant to use Facebook ads thus boils down three main points:

- Your target audience spends a lot of time on Facebook every day

- Facebook’s options allow restaurants reach specific audiences in specific areas

- Facebook has a good reputation, so it works.

Let’s now focus on ads. Before you actually engage in a Facebook ad campaign, you have to understand how to create ads that stand out. There are a lot of tricks and techniques that experienced marketers use, and we’re going to describe them in the infographic below.

It was created by experts from Assignmenthelper.com.au, and shares 11 great tricks to create Facebook ad designs that work.

11 Tricks to Create Great Facebook Ad Designs (Infographic) posted first on happyhourspecialsyum.blogspot.com

What To Look For in Servers for POS Systems

Hospitality and retail companies face numerous hardware challenges in their highly competitive and ever-changing environments. They need highly-configurable and cost-effective point-of-sale (POS) systems that are secure and reliable.

In selecting the right server for their POS system, they should look for platforms with three key characteristics: consistency, long server life, and the ability to handle multiple needs simultaneously to drive down costs.

Server as POS Backbone

A point-of-sale (POS) system means different things to different people – there is no one definitive POS configuration. Many technologies roll up into a typical solution, including networking, in-store Internet access, multi-function POS devices, customer kiosks, digital signage, hand held devices, as well as back office servers connected to a data center in cloud.

The back end server remains the backbone of the POS solution.

POS configurations and hardware tend to vary among three general application categories: table/hospitality/restaurants; retail (convenience store/grocery/chain); and medical (including dental and veterinary). In general, POS technology has shifted from closed proprietary solutions to more flexible solutions that give the retailer or restaurant owner better control and understanding of store operations. Most recently, POS solutions have begun to provide direct interaction with the customers, for example, tablets for ordering and paying.

While not as glamorous as these new tools and toys, the back end server remains the backbone of the POS solution. Depending upon the application, servers can provide multiple functions – a terminal, digital signage player, and a back office PC.

It should be noted that there is nothing innately different in a server used for a POS system than one for other industry verticals. There are some unique features, like connectivity and providing the required number of ports, but at its heart it is no different than a normal server. What makes a difference is the ability of the customer server platform to meet the required level of control over operations.

Rely on a Server Expert

Many resellers rely on large industry players like ScanSource for terminals, handheld devices, cash drawers, printers, power products, and other peripherals. While these POS giants may also offer backend servers, resellers frequently recommend that customers instead obtain their servers from a server expert. Many resellers are uncomfortable with buying their servers from the same vendor from whom they buy their cash drawers. Resellers should be looking for servers that are not tied into any particular software or hardware. Look for a vendor that has experience building cost effective servers for all POS applications. The focus should be on close interactions with resellers and a high level of customer service that allows each reseller to customize and configure exactly what their end users need.

Sometimes an end user company wants to use RAID (array of independent disks), or perhaps they want multiple network cards because they have an internal network and a credit card network that must be kept separate. Or they want to run Windows 7 on their server and have found that larger server manufacturers do not offer servers with desktop software.

Look for hardware product managers who work with each reseller to determine the required specifications and review the server hardware configuration options available. With this approach, resellers maintain an enormous amount of control over the server product they procure. Acting as a co-developer, product managers should come up with a POS server solution based on resellers’ unique technology, sales, and customer preferences.

Cost Reductions

For many POS end users, there is a distinct cost advantage to selecting servers that are approved to run both the desired POS software and a desktop operating system on a server platform. This can be especially beneficial for companies running on slim margins. Rather than having to purchase sophisticated servers and other hardware resources, they can combine functions into one piece of hardware and save significant dollars. The ability to provide a platform server with a desktop operating system means end users do not have to support multiple different platforms.

This makes a lot of sense, since in many instances there is no real need for complicated servers – these are just machines that are connected. No one is logging in, there is no active directory, and no need for replication and directory services. The servers simply need to share some files. So, the server side has minimal requirements. But – and it is a big but – end users still need the reliability a server can give, since desktop computers are not designed to run 24/7, with multiple hard drives.

There are many examples of POS resellers experiencing frustration with larger server manufacturers who do not know enough about the ins and outs of the POS business to be able to help them select the right server. Price and product availability may vary from month to month, or even week to week. Resellers have no control over which hard drives or video cards will ultimately end up in their servers.

Server experts should be enable resellers to lock down the precise unique configurations they are looking for, while still providing pricing competitive with major manufacturers.

Standardization Removes Risks

Standardization means providing the fewest number of product views to cover the greatest number of solutions. Some vendors have developed solutions in which the end user customers may get three to four boxes, all using one motherboard/platform, or at most two platforms.

Standardization means providing the fewest number of product views to cover the greatest number of solutions.

One might be in a smaller case, used up front at a checkout. One might be a workstation, like a low end back office server that can also be used by the restaurant manager for other tasks. This experience means end users can get the unique configuration they need while removing the risks inherent in customizing each server – like learning that one or another USB or network card does not work as required.

A huge advantage of this approach is that the end user does not have to support four different separate computers, each on different road maps. The need to support multiple images can be frustrating, as can the need to maintain multiple stacks of inventory for spare parts. Hardware product managers work directly with Intel, motherboard manufacturers, case designers, and component manufacturers, to lay out very detailed road maps and life cycles that resellers can count on.

Threat Management and Security Concerns

Security is one of the most important issues facing POS end users. Most are already compliant with Payment Card Industry Data Security Standard (PCI DSS) requirements, but there are many other aspects of threat management and security now being integrated into POS systems, albeit slowly.

Unfortunately, POS systems are lagging behind in security technology. The reasons are twofold: resellers do not like change and store owners balk at spending money on technology, running as they do on thin margins. Software companies have had to embrace these security measures and update their software, so they are starting to come around to the need for change. As they do so, resellers will also evolve to meet end user customer requirements.

There is a trend towards virtualization as a way of providing a higher level of security on back end operations. Virtualization is an excellent way of securing the POS environment, especially for those with multiple locations. Virtual servers by their nature are very secure. All vendors now want to secure credit cards, using mobile payment and digital wallet services, and to do so they will need secure virtual machine (VM) servers with hardened operating systems.

It should be noted that the lack of “appetite” for buying new technology was greatly exacerbated by the 2008 market crash, which affected restaurants and retail stores very badly. After many years in the doldrums, there has been a resurgence in sales. This already seems to be leading to an increase in purchase of virtualized infrastructure, with the security improvements that go with it.

Another trend that is having a major effect on security is the move to cloud-based, rather than local, infrastructure. In the past, if someone walked into a fast food restaurant and grabbed a computer and walked out the back door, the thief would be able to obtain an enormous amount of information. Many now still have a computer on premise – but it does not house information; it has all been stored with the credit card processors.

Resellers Can Provide What End Users Need

POS resellers need to be able to customize cost-effective servers that are stable, with long life performance, and managed technology roadmaps. Look for platforms that have been field-tested with the top-selling POS software packages, so resellers have access to a variety of computer server building blocks to provide winning end user solutions.

What To Look For in Servers for POS Systems posted first on happyhourspecialsyum.blogspot.com

Wednesday 25 April 2018

Make Your POS System Less Vulnerable to Cyber Attacks

In just the last few years, the retail industry has been a prime target for a multitude of cyberattacks. Point-of-sale (POS) systems have been particularly vulnerable, with debit and credit card readers being targeted in an effort to steal confidential financial information.

While some of the most well-known victims of cyberattacks on POS systems have included Michaels Stores, Target, and Neiman Marcus, small business owners are just as vulnerable when it comes to malware on POS systems. When such an attack occurs, it can have a significant effect on the confidence of consumers in the safety of financial information at POS terminals, eventually affecting sales.

While the increase in cyberattacks on POS systems can certainly be worrying to business owners, the good news is that there are steps that businesses can take to thwart cyber criminals from obtaining access to confidential financial data.

Reduce Your Risk

One of the first and most important steps that businesses can take in the quest to protect their POS systems from cyberattacks is to take advantage of layers of defense. The Target breach, among the most widely publicized, began with an attacker utilizing valid login credentials that had been previously authorized to a HVAC vendor.

Whether or not the vendor inadvertently or willingly shared those credentials remains unclear. The bottom line is that the login was authorized and authentic, thus giving the hacker the ability to attack the network with no resistance. While Target had an alerting system set up, it failed because both the login and the password utilized were on the approved list. For this reason, it is important to ensure that you do not simply rely on a single point of evaluation to protect your system. Closing all of the possible security loops is essential to ensuring the highest level of protection and preventing your POS system from becoming vulnerable to cyberattacks.

Begin by making certain that you have an incident response plan in place and that it is tested on a regular basis. In the event that you do become the victim of an attack, you want to make sure you are able to respond quickly and appropriately. Doing so can help mitigate damage and prevent customers from losing confidence in you.

Research Your Vulnerability

Take the time to perform a sensitive data audit to help you learn which as well as how many instances of confidential and sensitive data actually exist on your network. This could include personally identifiable information as well as credit card data.

After performing the audit, be sure to remove any instances of sensitive data that are not authorized, thus minimizing your system’s exposure to risk. While the number of cyberattacks on POS systems has been on the rise of late, taking a proactive approach can help you protect your business and your customers from would-be hackers.

Make Your POS System Less Vulnerable to Cyber Attacks posted first on happyhourspecialsyum.blogspot.com

Three Things Operators Overlook When it Comes to Food Safety

Your equipment is like your technology. When it’s working, it’s good on both sides of the counter. But with equipment, the stakes are higher when malfunction occurs, leaving you to wonder if your food is safe to serve. It’s never worth the risk; if a disruption is suspected, the inventory must be dumped.

That nearly happened to one Chick-fil-A operator in the Southeast, but good luck put him at his restaurant when one of his refrigerators began to fail; he noticed the glitch before the food went bad.

Would you be that lucky?

Here, the top three things to consider when it comes to refrigeration and food spoilage:

How Cold Is It?

Always have a number. You can track refrigeration in different ways, including using sensors that are easy to attach, but trusting your instincts or going by “feel” are big mistakes. As a general rule, refrigerator temperatures should be under 40 degrees or lower. When temperatures get above that, typically for more than two hours, the natural bacteria in food can double in as little as 20 minutes and be unsafe to eat. Remember to wrap raw poultry, meat and seafood to avoid contaminating other foods with the juices. Freezer temps should be zero degrees or lower.

Alerts

If your refrigeration starts to fail and you’re not on site as the Chick-fil-A operator was, how would you know? Invest in a system where the sensors are wired to send out alerts when temperatures start to rise above 40 degrees; Avery Dennison’s Freshmarx® Solutions provides several options.

Have More Than One Man on Watch

Protect yourself against technology glitches like a phone on “silent” or someone not noticing an alert. Select at least three key people to receive temperature alerts. Those three can communicate who’s going to take care of the temperature issue and, most importantly, that the message was received.

These three tips ensure operators avoid serving spoiled food, which is a serious problem in the service and retail industry. In 2016, the CDC estimated nearly 1 in 6—or 48 million people—get sick in the U.S. each year from foodborne illnesses caused by bacteria, viruses and parasites.

Essentially, refrigeration is the key to keep an incident from happening.

Aside from that, consider the money you lose when you throw away inventory when it’s been temperature-compromised. On average, an operator’s refrigerated inventory at any time is worth $10,000, with equipment failures averaging about twice a year. Unless you can afford a so-called $20,000 bath each year, it’s worth a little time and effort to set up some precautions.

Do your homework when researching temperature tracking systems. Some include basic functions while others will measure humidity in addition to temperature. Select a system that takes advantage of technology, alerting by text. Some systems work with your Wi-Fi while others are stand-alone systems and require no merging of technologies. Decide which works best for you.

Protect your brand and your investment by keeping things cool.

Three Things Operators Overlook When it Comes to Food Safety posted first on happyhourspecialsyum.blogspot.com

Tuesday 24 April 2018

Is the Restaurant ‘Experience Economy’ Overrated?

A lot of emphasis has been placed on the “experience economy” and it seems many restaurants are looking to offer something ‘different’ to attract customers. Whether it’s a robot waiter, interactive dining tables or a kooky menu, the sense that a brand needs to stand out from the crowd in order to beat off the competition is pervasive. At a time when many food chains in the U.K. are struggling, there’s a divide between what consumers want from a place to eat, and what the industry thinks they want.

54 percent of restaurants think customers are looking for a unique experience – they’re wrong.

According to fresh research by digital ordering technology provider Preoday, this attention may have been misplaced. During this time of industry struggles, perhaps more care needs to be given to those essential elements customers care the most about. It is estimated 54 percent of bar, pub and restaurant professionals believe consumers are looking for a unique experience, however, just 21 percent of consumers actually factor it into their choice of eatery and a tiny 2 percent see is as the most important feature.

The research explored whether industry professionals understand the true needs and wants of customers. Asking consumers to identify what they look for in a food venue, it found that a great menu (91 percent) came out on top, closely followed by the quality of the food (85 percent). When asked what it is about the menu that most appeals, 57 percent of consumers said it was the variety, while 44 percent referred to the descriptions used and 26 percent were drawn in by the format and appearance.

The professionals recognized the importance of the menu, though they put the importance of food quality (69 percent) in front of the menu itself (63 percent).

Also at odds with consumer opinion was the importance of great staff – while, at 66 percent this was the third most important feature for consumers, less than half (46 percent) of the professionals identified high quality staff as a key need for customers.

Data for Menu Success

Just over half (56 percent) of the professional respondents, whose businesses let customers order food via a website or mobile app, are being given access to customer data by their technology supplier.

Preoday asked those with access what they are using the gathered data for: 71 percent are making use of it to improve their marketing but less than half (48 percent) use it to improve their menus and operations.

Where possible, customer data should be gathered and applied to the benefit of the business; the information it provides can be used to decipher the most popular items on a menu, the average spend for customers per course and how choices change according to the season and around events. It’s great that 48 percent are using their data in this way, but it means more than half are not and could be losing customers – most of whom, our research shows, are judging them by their menu.

Testing the needs and demands of customers against their favourite food and drink venues, Preoday asked consumers to nominate their favorite restaurant chain. The most popular response was TGI Friday’s, followed closely by Wagamama and then Zizzi, though it should be noted that an equal number of people claimed to dislike or not have a favourite chain, as those that selected TGI Friday’s.

Consumers commented on what they do and don’t like about eating out:

Birgitta, Yorkshire : “I will choose a restaurant based on the food being offered, something interesting or out of the norm will always attract me. If I’m planning where to go, I turn to online reviews to help me decide. Maybe it’s just me, but I like somewhere that’s not so loud that I can’t hold a conversation!”

Tom, Surrey: “The thing I love about eating out is that I can eat food from all different cultures and of a quality that I couldn’t hope to produce – whether through time constraints or a lack of skill. I’m put off eating out where the food is prohibitively expensive or easy to reproduce – it’s very rare that I will order pasta for example.”

Jennifer, Essex: “When I go out to eat it’s usually so I can socialise with friends or family, I want somewhere that has a relaxing atmosphere and where I feel looked after. I’m also keen on menu variety and trying something different. If a place has a bad atmosphere it’s a no-no for me.

Catherine, London: “When I eat out I’m looking for food which I wouldn’t be able to, or want to, cook for myself at home. To me, eating out is an occasion, I use it to catch up with friends and I like to take my time, not be rushed out of the door. If the service is unfriendly at a restaurant, I am unlikely to return. Similarly if the environment is uncomfortable or imposing.”

Preoday’s report reflects the anonymised responses of 476 consumers and 205 food and drink service professionals, based in the UK, during March – April 2018.

Is the Restaurant ‘Experience Economy’ Overrated? posted first on happyhourspecialsyum.blogspot.com

The Romaine Ingredient: Food Safety Facts for Restaurants

“Ask the Expert” features advice from Wade Winters, Vice President of Supply Chain for Consolidated Concepts Inc.

Please send questions for this column to Modern Restaurant Management (MRM) magazine Executive Editor Barbara Castiglia at bcastiglia@modernrestaurantmanagement.com.

Q: What do you do as a restaurateur if you have romaine as a base of menu items? How do you turnaround if you have to stop serving it? Should you avoid it to allay fears? And, how do you relate your food purchasing to your guests? Where should restaurateurs go to get information when cases like this happen to make themselves aware so they can respond? Is it building good supply-chain relationships?

A: As of April 20, 2018, the FDA expanded warnings from an ongoing E. coli investigation related to romaine lettuce grown in Yuma, Ariz. The Centers for Disease Control and Prevention reported that 53 people in 16 states were sickened by the outbreak since mid-March. While no deaths were reported, 31 people were hospitalized.

Unfortunately, food recalls are inevitable in the restaurant industry. It is very important to be aware of all alerts and determine if your restaurant and guests are potentially impacted. Produce suppliers are a good resource for information on these types of recalls and should be able to identify if any product involved in the recall were sold to your restaurant. Produce distributors are required to implement stringent traceability standards and should know where every case of product ended up in the supply chain. The FDA and CDC websites are direct sources for updates on all recalls and should be checked frequently. Both websites provide you with the ability to sign up for alerts which is a great idea to do if you are in the restaurant industry.

Restaurants should immediately communicate to their guests and give them assurance that they are not implicated by the recall, and that their food is safe. This can be done through a simple sign at the entrance, a “note” on the menu, and by having the wait staff communicate the message to the guest. It would also be appropriate to have this posted to the restaurant website and through any suitable social media platform. Ongoing updates should be provided until the recall has “officially” ended as announced by the FDA and CDC.

If a recalled product such as the romaine is a major ingredient for the menu, it can sometimes be difficult to come up with alternatives. However, with some creativity there are options to consider. For example, if romaine can’t be used there are other lettuce items such as iceberg, spring mix, green and red leaf, spinach, butter/boston, baby kale,and bibb. While these may not have the same texture as romaine, they are viable replacements. Guests will appreciate the fact that you are looking out for their safety and will likely understand the need for temporary alternatives.

The Romaine Ingredient: Food Safety Facts for Restaurants posted first on happyhourspecialsyum.blogspot.com

The Holy Grail of Retention: Five Steps to Building New Young Leaders in Your Restaurant

Restaurant managers are noticing a problem that has been growing over the past few years, in not just their own, but every industry: there is a big leadership gap. Many are asking themselves, “How are we supposed to find those people who have sufficient technical skill to be in charge of a restaurant, but are also suited for leadership?”

There are a lot of people who are committed to their work, but are reluctant to take on supervisory roles.

This is the Holy Grail of retention: identifying and building new leaders. It’s not just retaining the best technically skilled talent. Rather, it is retaining those with the best technical ability who are also willing and able to take on leadership responsibilities and helping them step into those roles successfully. How many people have both the specialized skills and the desire and ability to lead?

The problem is, especially among the best young talent, that there are a lot of people who are committed to their work and careers, but are reluctant to take on supervisory roles.

Why?

The main reason, according to our research, is that they can see with their own eyes the experience of their own managers and their slightly more advanced peers. What they see is that managers, especially new managers, are often given loads of additional responsibility with very little additional support.

What do new managers need? They need support and guidance in learning and practicing the basics of management.

When you ask a young start to step up and make the transition to a leadership role – at any level – you owe it to that new leader and their team to make sure that they are fully prepared to take on additional responsibilities and authority. Teach new leaders how to do the people work, and then support and guide them in this new role every step of the way:

- Explain that this new role carries with it real authority, that it does not award them license, of course, to act like a jerk. It is a huge responsibility that should not be accepted lightly.

- Spell out for the new leader exactly what their leadership responsibilities look like. Explain that management entails more than completing some extra paperwork. You have to explain the “people work” in detail. Create standard operating procedures for managing and teach them to all new leaders. Focus on the basics, like spelling out expectations for every employee who works for them, following up regularly, tracking performance closely in writing when possible, and holding people accountable for their concrete actions performed on the job.

- Make sure you formally deputize any new leader, no matter how small the team or how temporary the duration of the leadership role may be. You need to announce the new leadership to the whole team, articulate the nature of this person’s new authority, and explain the standard operating procedures for management that you have asked the new leader to follow.

- Check in daily (or every other day, or as often as makes sense) with this new leader. Regularly walk through the standard operating procedures for managing people. Ask about the management challenges they are likely facing. At first, you might want to sit in on the new leaders’ team meetings and one-on-ones with team members in order to build up this new leader. Do everything you can to reinforce their authority with the team and every individual on the team. But make sure to take every opportunity you can to help the new leader refine and improve their management techniques.

- Pay close attention every step of the way and evaluate the new leader in their new role. Some new leaders will practice the basics with great discipline; some won’t. Some will be consistent in their application of the basics; some won’t. Some will grow comfortable in their new leadership role. And some will simply fail in the leadership role. But it turns out that with the right amount of guidance and support most people who are very good at their jobs and committed to their work and careers have the ability to grow into strong, competent leaders.

With this kind of sustained low-tech, hands-on leadership development effort and constant evaluation, you can develop your future leaders. Who will move along that path and grow into a high-level leader? Look for those young employees who love the responsibility and the service. They will likely be your future leaders.

The Holy Grail of Retention: Five Steps to Building New Young Leaders in Your Restaurant posted first on happyhourspecialsyum.blogspot.com

Monday 23 April 2018

MRM @ the bar: The Sheridan

In this edition of MRM @ the bar, Caitlyn Ritz, Mixologist/Head Bartender at Ho-Ho-Kus Inn + Tavern crafts The Sheridan.

The Sheridan

Ingredients

1 oz Meyer Lemon Juice

1 oz Lavender & Thyme Syrup

2 oz Meyer Lemon Infused Vodka

2 Sprigs of Thyme Lavender Dust

Lavender Dust

2 Tbs dried lavender

2 Tbs sugar

Throw both ingredients into a spice grinder and pulse for a few moments.

Directions

Muddle one sprig (leaves only) of thyme with syrup.

Add rest of ingredients.

Shake vigorously with ice and double strain into martini glass.

Sprinkle Lavender dust on top and garnish with sprig of thyme.

MRM @ the bar: The Sheridan posted first on happyhourspecialsyum.blogspot.com

Outside the Box: Why Restaurants Need to Rethink Delivery

As a restaurant owner myself, I entered the world of delivery hopeful that we would see significant incremental sales and profits through the channel pushed open by millions–now billions–of dollars in marketing from GrubHub, UberEats, DoorDash and others. I was hopeful that this would be the case, because that’s what I was told in the countless emails I received promoting the various delivery services.

And then reality struck.

30 percent?

You want 30 percent?

Why?

Do you know anything at all about the restaurant business?

Do you have any idea how thin our margins are?

(These loud thoughts banged around inside my head as I reviewed the thick contract sent by the first provider I chose.) The sales rep patiently explained to me, as I’m sure she does to countless restaurateurs around the country, that that’s what it costs for the service to recruit new customers and also to recruit drivers. If I didn’t want to pay it, no problem. I didn’t have to use the service. I didn’t want to lose all those incremental sales. So, just like a lot of restaurateurs before me and a lot who came after, I signed up.

My challenge is that I am reminded every day just how much this is costing both me and my customer. On one order the numbers start to get clear… Total amount paid by the consumer: $30.18. Total cost of the food: $18. Total remitted to my restaurant by the delivery company: $12 Wait, so you collected $30 from this guy, but you’re only paying me $12? That’s a lot more than 30 percent. Of course there’s tax, but even in tax-rich L.A. that’s only $2.19. The delivery service tacked on a delivery charge, $6.99, and the consumer paid a tip (goes to the driver) $3. So that’s how you get to $30 from $18.

Okay, I sort of understand all of that when I break it down. The big challenge, though, is when I get the monthly statement and it tells me that total revenue from delivery was ±$3K but I’m only getting ± $1.9K. So they made $1,000 on me this month. How much did I make? Well, if I factor in all of my costs, producing the adjusted $2K in sales cost roughly $1.6K. So, for all of my pain and anguish, I only made $400.

Why bother?

Many restaurants will see bigger numbers across the board. Bigger sales, higher costs. Some see smaller, but their margins are going to be pretty consistent with mine and I can see why they get frustrated with delivery’s bite out of their profit pie. And so, when I talk to most restaurateurs and there is a growing sense of, almost, animosity with regard to the delivery providers, I have some sense of where they’re coming from.

Something has to change.

At a recent restaurant conference, I sat in a large room with a bunch of other restaurateurs and listened as C-level executives from the delivery services shared their vision for the future. Some mentioned robots and autonomous cars. Some mentioned an ever-broadening landscape of logistical fulfillment. No one said their fees are coming down.

This, of course, frustrated the restaurants. I hear that frustration, but I don’t think the 30 percent is going away any time soon and the reason is simple economics. The top three delivery services, GrubHub, DoorDash and UberEats, are locked in a terminal battle for market share. They all have deep pockets and huge bank accounts. Their challenge is that none of them has a dominant share of the market. Enter Amazon with their own offering from Amazon Restaurants. While they don’t have a lot of market share yet, there is little question that they’ll make a difference, but whether they do more than just further divide the market is really anyone’s guess. Of the four (if I include Amazon), only GrubHub is profitable, and their profits are thin. Given this lack of profitability and the fact that the 30 percent restaurants are paying is their primary source of revenue, decreasing these fees would essentially be suicidal for these firms.

So the 30 percent isn’t going away. But where many restaurateurs are arriving at a conclusion that the delivery services are “trying to push them out of business,” I believe nothing could be further from the truth. The services can’t survive without restaurants. So clearly that’s not their objective.

After thinking about it quite a bit, the conclusion I’ve reached is that we’re in a nascent stage market. While the concept of delivery has been around for a long, long time, primarily in pizza, the entry of delivery apps in the marketplace to drive real purchasing volume is relatively new.

So everyone is trying to figure it out.

This caused me to take another look at delivery in my own restaurant. Are there things I can do to make it work better? The answer is a resounding, yes! Here are the questions I asked myself.

What if I increase the menu pricing on the delivery menu?

Why do I offer my whole menu for delivery?

Why not condense it to my most profitable items?

How do I increase revenue from customers who come to me through delivery?

Are the customers truly incremental or are they people who already come to the restaurant?

Increasing the pricing on the delivery menu. I immediately dismissed this idea. Our restaurant menu is online and customers would see the price difference and likely resent it. While I might be able to explain it to those who asked, there would still be a lot of people who simply choose not to order and may consider Town untrustworthy because of this practice.

Offering a limited menu. Here I decided I was on to something. Not only could I increase margin by offering only high profit-margin items, but I found that most of the items I was going to take off the menu don’t travel all that well. So I provide a better consumer experience at a higher margin.

Increasing revenue from delivery customers. I started to look at the delivery bag as my own marketing opportunity. What am I putting in the bag? If I am just putting the food in the bag am I missing an opportunity? Heck yes! So now I put a coupon in the bag for a discount on the customer’s next visit to Town. Just because someone orders delivery sometimes doesn’t mean they always order delivery. Sometimes they eat out. By giving them an incentive to come to Town I’m encouraging them to eat at the restaurant. Incrementality is hard. Because I know my customers, I know that many people who order delivery are people who already know and love Town.

The thing is that as my delivery business has grown, so has our reach into new customers who haven’t been to the restaurant. It hasn’t happened often, but people have started to tell us in the dining room that they found out about the restaurant by ordering online. I see that as a good thing and am taking steps to see if I can maximize our reach in this way as well.

More importantly, I started looking at delivery as a marketing cost. There is no question in my mind that the better we do in providing a great product at a great price within the constraints the consumer is already accepting for the service, we are increasing our reach into our local community. So the 30 percent I’m paying to the service is akin to a marketing expense. Is it my best use of marketing dollars? Well, I’d say no. The best use of our marketing dollars remains staff training, ensuring that as much as possible, every customer who comes to our restaurant has a great experience every time. But I would say that given its focus, reach and relevance, this may be the second best marketing expense I have, and there is no question that I, and we, can just keep getting better at it. And perhaps that’s good enough for now.

Outside the Box: Why Restaurants Need to Rethink Delivery posted first on happyhourspecialsyum.blogspot.com

Friday 20 April 2018

MRM News: Cashless and Veggie-Full at Dos Toros

Due to customer request, fast-casual Mexican chain Dos Toros, recently introduced a vegetable entree option, marking the brand’s first menu change in six years. The market vegetable item includes a blend of seasonal selections including squash, peppers, Cremini mushrooms and Tuscan kale sautéed in a coconut oil. The chain also recently instituted cashless payment systems to provide a better experience for both guests and teammates.

In this MRM News video, Leo Kremer, Co-CEO & Co-Founder discusses the menu and tech innovations at Dos Toros as he delves into the thought process behind adding a veggie option and the advantages of going cashless.

MRM News: Cashless and Veggie-Full at Dos Toros posted first on happyhourspecialsyum.blogspot.com

FLSA Amendments: Congress Extends Tip Sharing to Back of the House Employees

On March 23, 2018, Congress amended the Fair Labor Standards Act (FLSA) to remove the prohibition on tip pooling, subject to certain circumstances. Under the FLSA, an employer is permitted to pay a reduced hourly wage to tipped employees, provided the employees receive enough tips to bring hourly wages to the federal minimum wage. Employers may claim credit for tips the employees have received both directly and as a distribution from a tip pool.

The amendment to the FLSA details that “An employer may not keep tips received by its employees for any purposes, including allowing managers or supervisors to keep any portion of employees’ tips, regardless of whether or not the employer takes a tip credit.” Notably, the amendment now permits tip sharing between tipped and non-tipped employees (excluding managers and supervisors), as long as the employer pays full minimum wage rather than the tipped minimum wage to its employees and does not take a tip credit. Previously prohibited, this practice resulted in a wage disparity between traditionally tipped employees (like servers) and other staff such as cooks and dishwashers. As the U.S. Department of Labor (DOL) noted, despite the contribution by these back of the house employees to the overall customer experience, many may receive less overall compensation – stated in its December 2017 release. (See Share Tips Between Traditionally Tipped and Non-Tipped Workers, released 12/4/2017, https://www.dol.gov/newsroom/releases/whd/whd20171204).

Following the amendment, the DOL issued a bulletin stating that a prior policy promulgated on or about July 20, 2017, of non-enforcement for retention of tips by tipped employees paid the full FLSA minimum wage would not apply to new investigations beginning after March 23, the effective date of the amendment. Restaurant owners should take care to adopt the change, but remain aware that prior tip sharing practices may still be subject to investigation.

Assuming you pay the full minimum wage, employees who are not regularly tipped – such as chefs, cooks and dishwashers – are now permitted to be incorporated in tip pools. Tip pooling remains prohibited for subminimum wage, and tip pooling for employers, managers or supervisors is prohibited no matter what.

The Amendment provides enforcement authority by allowing employees to recover all tips unlawfully kept by the employer, in addition to an equal amount in liquidated damages. The DOL’s Wage and Hour division is also permitted to impose civil penalties, not to exceed $1,100 when employers unlawfully retain employee tips.

Employers with tipped employees should end any practice of collecting and retaining or redistributing tips. As long as employees are paid federal minimum wage and the employer does not take a tip credit, tipped employees may split tips with non-supervisory, non-tipped employees. However, if employees are paid the tipped wage ($2.13/hour) and the employer takes a tip credit ($5.12/hour), tip splitting is not permitted.

Restaurants should consult with legal counsel to determine the best measures to maximize payment for employees while reducing operating costs.

FLSA Amendments: Congress Extends Tip Sharing to Back of the House Employees posted first on happyhourspecialsyum.blogspot.com

Thursday 19 April 2018

Concept Testing: Does Menu Pricing Matter?

Whether to include the price in early stage concept testing is an important question. Some people argue that price needs to be presented, so that people can make an informed decision. Others say that price can’t accurately be known at the time of early stage concept testing, and that putting a “fake” price on the concept could result in misleading feedback. To find out what the effect might be, we ran a test, using concepts for potential menu items for a globally prominent quick service restaurant (QSR).

One arm of the test saw descriptions of potential mains, with a price. The other arm saw them without a price, but they were told “assuming the price is reasonable to you.” Ten concepts were tested, with seven measures, including purchase intent. A 95 percent confidence interval was used to test for differences.

A Mixed Bag

There were very few differences between the priced and unpriced arms. And the variations that exist do not tell a clear story. Out of 70 comparisons, there were seven statistically significant differences. For three of these, price appeared to increase regard for the concept. In the other four, price appeared to decrease regard. Further, these discrepancies were found across five different concepts.

One of the concepts was a lower cost breakfast item. Showing its price increased regard for it significantly on two measures, and it showed a positive directional impact on the other measures as well. In this case, the price may have been useful additional information, because people noticed the lower price.

A second concept showed price having a negative impact on two measures, but that impact did not show up consistently across all the other measures for that concept. That offer had an average price. It may be that these differences, and the other more random ones, were just noise. We would expect to see, based on chance, three or four differences in a test like this.

“So What, What’s Next?”

I interviewed Sydney-based strategist Michael Haynes the other day, for a book I am writing. His bottom line for research is “So what? What’s next?” That’s a very concise way to cut to the chase. These findings don’t tell us a clear story.

So what? That means we have choices. We can include price. Or not include it.

In the case of the lower cost breakfast item, including price had a positive effect on interest. This suggests that mentioning cost, as a matter of routine, could be beneficial in some circumstances. In the case of the other offers, including price made no clear difference—positive or negative.

Price is what you pay. Value is what you get. – Warren Buffet

It should be noted, however, that this is a market and a brand with a relatively tight price band for their menu. There are no expensive luxury offers, and no bargain basement ones either. Most of the food this brand sells is available within a relatively narrow price range—and consumers know it.

What’s next? In a market where there are large and important differences in price—like automobiles—including cues like price is essential in concept testing. Likewise, in testing early stage ideas for innovative technology, where price is generally unknown, the price is important.

In the QSR world, however—especially with a well-known brand, with a well understood price range—it may not matter. But the example of the lower cost breakfast item suggests that including it can be helpful at times.

Our recommendation? First, be consistent. Don’t mix concepts with price, and concepts without. That will draw attention to price, and it won’t be helpful. Secondly, we recommend including price because it can help people make a more informed choice—especially in edge cases. These data, however, suggest that in this well-understood and tightly price banded market, you can go either way—just be consistent.

Our research on idea screening has shown that our Idea Filter approach can succinctly test ideas in less than a minute—making it three times faster than traditional methods. And it is more sensitive to differences between concepts.

To learn more about Idea Filter and our QSR offer, check out our e-book Tumultuous Times: A Quick Service Restaurants Guide to Thriving and Surviving.

“Price is what you pay. Value is what you get,” said Warren Buffet. In this case, the value is in the eating.

Concept Testing: Does Menu Pricing Matter? posted first on happyhourspecialsyum.blogspot.com

What Are Some Spring Dining Trends for 2018?

“Ask the Expert” features advice from Wade Winters, Vice President of Supply Chain for Consolidated Concepts Inc.

Please send questions for this column to Modern Restaurant Management (MRM) magazine Executive Editor Barbara Castiglia at bcastiglia@modernrestaurantmanagement.com.

Q: What are some spring dining trends that I should consider?

A: As the season changes, restaurants kick their operations into full swing with the promise of busy shifts ahead. Spring means early crops likes leafy greens, asparagus and berries. Berries’ short shelf life and volatile commodity prices make them somewhat risky to bring in the door, but no Spring brunch, cocktail or dessert is complete without them. California strawberries hit peak in the market from March to July, while domestic blackberries and blueberries become abundant starting in April and May. It’s worthwhile for operators to look into when regional blueberries are in season and offer them as a highlight on the menu.

The majority of berries freeze incredibly well and lend themselves perfectly to compotes, desserts and cocktails. If the berries in your walk-in are about to turn and you are able to incorporate them into your menu, pureeing them and freezing them dramatically extends their shelf life. The frozen berries are useful throughout your menu: in smoothies, as hot or cold cereal toppings, in parfaits or in pancakes, waffles, scones or muffins. For a novel take, blend pureed berries into cream cheese to make custom toppings or fillings for French toast.

Prime Primavera

The fresh flavors of Spring are enhanced by the inclusion of fresh herbs in recipes. One relatively cheap and simple way to up your décor and your flavor is to grow your own herbs. Herbs can be planted in view of the dining room and can be a huge boost to the dining experience as guests receive fresh bowls of pasta primavera garnished the herbs grown in view of the table. The herbs can be used throughout the menu in entrees, cocktails, salads and even desserts. Furthermore, Basil, Rosemary, Lemon Verbena, Lavender, Sage, Tarragon and Thyme are all finding their way into cocktails crafted by creative mixologists.

With the exception of basil, all herbs should be stored between 32-36 degrees and protected from drafts, which will result in dehydration and wilting. Basil is best stored between 45-50 degrees.

Spring dining also means Spring salads. And Spring salads, of course, mean the now-ubiquitous Spring mix. But not all Spring Mixes are created equal. Consider not only flavor and color, but plate coverage when choosing the right leaf mix variety. There are also many other inventive salad mixes to consider that feature on-trend ingredients such as arugula, brussels sprouts, chard and, of course, the ubiquitous Kale leaf.

For many veggie lovers, the end of winter means asparagus. California’s asparagus season starts in mid-March and runs into June. Domestic asparagus typically costs more than imported asparagus coming from Peru and Mexico due to asparagus being one of the most labor-intensive commodities that there is and the higher labor costs associated with domestic hand-pickers drives the price higher.

Lastly, for operators, Mother’s Day can be one of the biggest sales days of the year. Spiralized vegetables will be a popular substitute this Mother’s Day. Veggie “noodles” are a tasty and popular alternative to the traditional variety, and will be a big Mother’s Day dish as well as on specials menus throughout the season.

What Are Some Spring Dining Trends for 2018? posted first on happyhourspecialsyum.blogspot.com

Wednesday 18 April 2018

Tuesday 17 April 2018

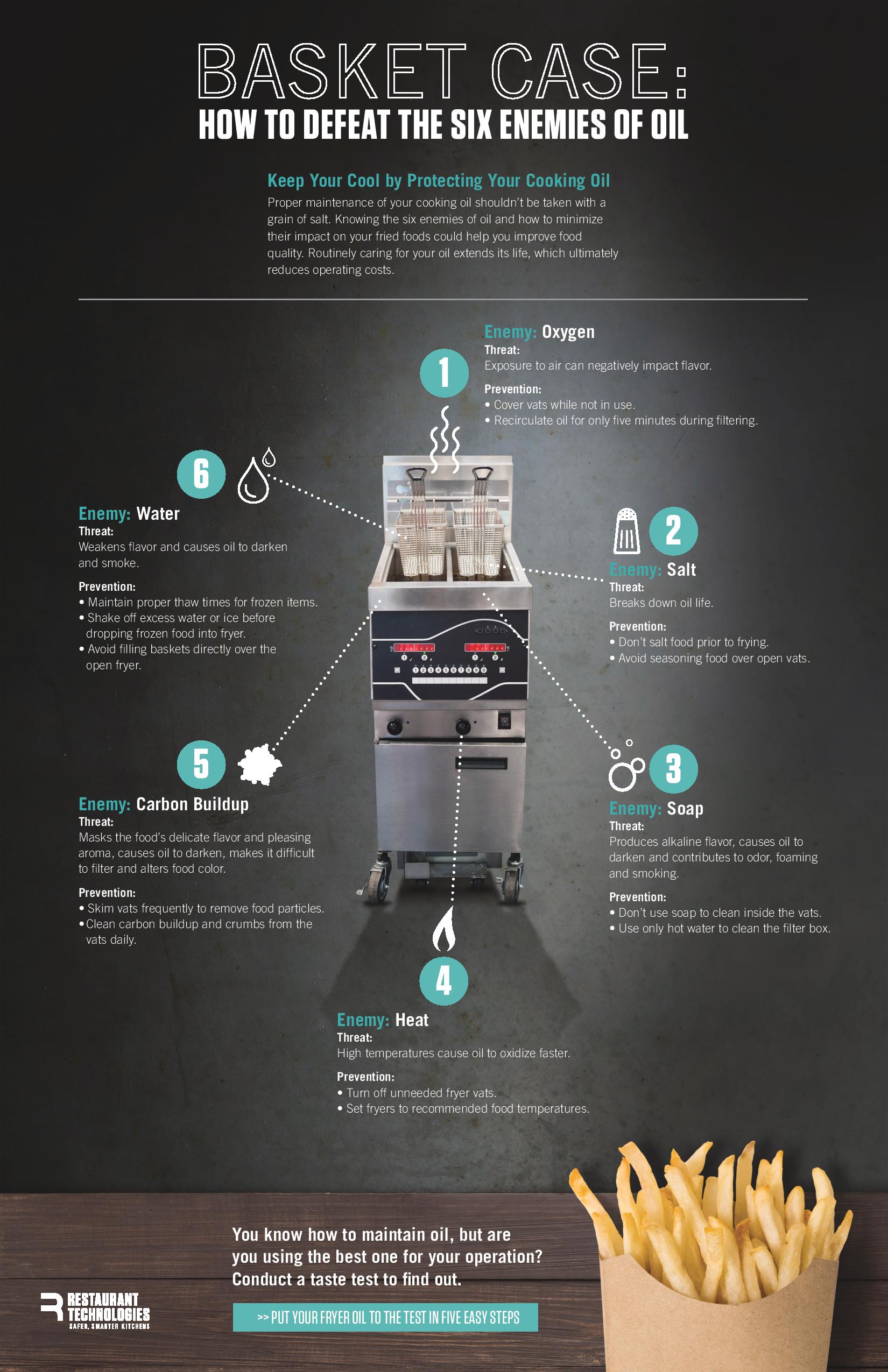

Basket Case: How To Defeat the Six Enemies of Oil (Infographic)

Restaurant operators know well that cooking oil is one of the biggest costs when it comes to food preparation. Knowing what may negatively affect your cooking oil, and ultimately the taste of your food product and bottom line is imperative.

Consider the following enemies of cooking oil: Oxygen, salt, soap, heat, carbon buildup and water. All of these elements pose a great threat to the quality of your restaurant’s cooking oil and food you serve, and are abundant in any commercial kitchen.

Restaurant Technologies shares how these threats are harmful to cooking oil, and how restaurant staff can steer clear of these six enemies to maintain the quality of your cooking oil, and even extend its life.

For more on this and other helpful tips, click here.

Basket Case: How To Defeat the Six Enemies of Oil (Infographic) posted first on happyhourspecialsyum.blogspot.com

Why Your Menu Holds the Key to Marketing Success

Menus and recipes are usually the job of a chef hired to run your kitchen, but hiring a restaurant consultant can be a great option as creating a menu goes beyond just creating the food.. Not all chefs/kitchen managers/restaurant owners also have the skillset to be creative writers/mathematicians/recipe developers.

Creating a menu goes well beyond just creating the food.

And with the mneu being the the top marketing tool, no one can afford to take shortcuts on it. It is also the planning tool and is responsible for:

- Getting customers in the door or getting online orders

- Cost and prices of the items

- Profitability of the items

- Kitchen layout

- Storage capacity

- Labor

You may be opening up “just” a tiny hole-in-the-wall coffee shop, but if done correctly, it can be a goldmine if you understand how to offer the right items at the right price that both sound and taste incredible.

Adaptive Reuse

For example, house-made Kettle Potato Chips are always popular and sound great on the menu, but can be a logistic nightmare. Don’t just think about how great an item sounds; make sure you can make enough of it fast enough, that it can be made ahead and stored if necessary and create no waste. Make sure there is some cross-over between items to be a responsible restaurant owner. If you are serving coffee, have something with coffee on the menu that can be made with leftover coffee such as a mocha swirl cheesecake made by turning excess coffee into a coffee syrup. Or if you serve alcohol, invent a Coffee Cosmopolitan.

Pricing

I recently had a potential client show me a menu with prices and asked my opinion. The first thing I asked was if the items weren’t completely developed and there were no recipes, how did you come up with the prices? Sometimes prices are created first based on a competitive analysis of the location and what the market can bear. Then the recipe and ingredients are created backwards with a bit of psychology thrown into the mix. However, you must be sure your costs will be covered.

This was not the case with this client. Another consideration as well is if the items will be packaged “to go” as the packaging costs must be built into the customer price. Years ago, whether most customers knew it or not, extra charges were built in for to-go containers.

Creative Copy

Creative writing skills are needed to craft a menu that sounds appealing to customers. This is an acquired skill that is built over time. Given the choice of an Angus Burger served on a House-Made Brioche Bun with Vermont Hill Cheddar, Grilled Oahu Onions and Kumata Tomatoes served with Gus’s New York Pickles or a “Burger served on a sesame bun with lettuce, tomatoes and pickles,” which would you choose? The exact same item can sound worlds apart and cost more just based on how it sounds. Let the customer know what great ingredients you are using and make the dish sound fabulous.

To pound home the point again, the menu is your top marketing tool and must be done correctly to ensure financial success. Being proactive and hiring a needed consultant can make the difference between a busy, full capacity restaurant and one that has the great food, but no one is clamoring to try it.

Why Your Menu Holds the Key to Marketing Success posted first on happyhourspecialsyum.blogspot.com

The Tax Cuts and Jobs Act: Evaluate the Impact for Your Restaurant Business

For restaurateurs, there are a lot moving parts to the Tax Cuts and Jobs Act to consider. When the Act was ratified, high-fives were the order of the day. To many it signaled a possible end to sluggish growth, or a golden ticket out of irrelevancy. But savvy restaurateurs are evaluating exactly how the Act impacts their overall tax position.

To help you navigate through some of these moving parts and identify how best to maximize potential benefits or minimize potential costs arising from it, continue reading to see some things that have and haven’t changed, and what you should consider when evaluating the impact the Act may have on your restaurant business.

So, What Hasn’t Changed?

For starters, the Work Opportunity Tax Credit (WOTC). This beneficial-but-often-ignored federal credit is for the hiring of certain classes of employees (low income, students, veterans, ex-cons). Previous WOTC provisions remain unchanged under the new tax law. Another federal credit that remains is the FICA Tip Credit. This is for employer FICA taxes paid on tips to employees.

So, What’s New?

Well, a lot of things. But since I’m on a strict word limit, it’s difficult to get to everything. For nitty-gritty details, consult a lawyer and a highly qualified tax professional. Here are some highlights:

Bonus Depreciation

Historically, this provision allowed for the immediate expensing of 50 percent of the cost of certain qualified property. The Act has significantly increased the benefits of this provision. Taxpayers are now able to deduct the entire cost of qualified assets acquired and placed in service after September 27, 2017. But don’t pop the champagne just yet. If you had a binding contract in place for property prior to September 28, 2017, that date will be considered the acquisition date for this purpose and your bonus depreciation on such assets will be based on the prior law.

It’s important to note that the Act expanded the type of property eligible for bonus depreciation to now include used property; historically, only “new” property was eligible. The used property must fit within one of the categories of qualified property and must be acquired and placed in service on or after September 28, 2017. The used property must not be property that was previously owned by the taxpayer and cannot be acquired from a related party.

Section 179 Deduction

The Act increased the expense limitation to $1 million (from $500,000) for additions for qualified assets placed in service after December 31, 2017. Additionally, the phase-out of this benefit does not begin to occur until there are $2.5 million (up from $2 million) of qualifying additions. The Act also broadened qualified property to now include certain real property, including roofs, HVAC, fire, alarm, and security systems.

Tax Rates

All individual tax brackets were reduced, with the highest rate – that for individuals filing jointly – decreasing from 39.6 percent to 37 percent once income is over $600,000. Similarly, the corporate income tax rate was reduced to 21 percent from 35 percent — but you probably knew that already.

Pass-Through Entity Deduction

A new 20 percent deduction for taxpayers with income from S corporations, partnerships / LLCs, and sole proprietorships was created. The deduction is equal to the lesser of 20 percent of Qualified Business income (QBI) or a limitation based on the greater of the two tests below:

- 50 percent of the taxpayer’s pro-rata share of W-2 wages paid by the entity; or

- The sum of 25 percent of the W-2 wages with respect to the business, plus 2.5 percent of the basis of all qualified property.

The W-2 and/or asset tests above would not apply if the taxpayer’s taxable income was below the threshold amounts set forth in the Act ($315,000 for taxpayers filing a joint return; $157, 500 for single filers).

Limit on Deduction of Business Interest

For tax years beginning after December 31, 2017, there is a new limitation on the amount of interest expense that a taxpayer may be able to deduct. Essentially, a taxpayer’s interest expense will be limited to 30 percent of the entity’s adjusted taxable income (ATI). ATI is taxable income before deduction for interest expense, depreciation, amortization, or depletion, any net operating loss deduction, or interest income – any interest expense above that amount is “disallowed” as a deduction in the current year. This limit does not apply to taxpayers with average annual gross receipts for the three-year period ending with the prior tax year not in excess of $25 million.

Meals and Entertainment Expenses

For tax years beginning after December 31, 2017, the cost of business meals will still be deductible as they were before. But no deduction will be allowed for entertainment, amusement, or recreation activities. Accordingly, taxpayers will need to identify non-deductible entertainment activities, and will continue to identify business meal expenses subject to a 50 percent limitation. However, the 50 percent limitation on the deductibility of meals will now include meals provided via an in-house cafeteria or otherwise on the premises of the employer.

So, What’s Next for You?

You need to consider the changes outlined above along with a few not covered raise several questions, opportunities, and challenges to restaurant owners. Ask a qualified professional:

- How should I structure my business?

- Should I change my entity from a pass-through to a corporation or vice-versa?

- Should I immediately deduct all my fixed asset purchases prospectively (regardless of my entity type)?

Historically, choosing the type of entity to hold a restaurant was a straightforward-but-cumbersome process. Keep in mind that one should not rush to the conclusion that forming a C corporation is more beneficial than forming a pass-through entity.

Overall, there will be winners and losers under the Act, and it seems the advertised simplification of the new tax law may suffer from over-hype—at least for business owners. The complexity of these provisions should be carefully analyzed. The items outlined in this article present a useful starting point for restaurant owners and operators as they work to understand exactly how the Act impacts them.

The Tax Cuts and Jobs Act: Evaluate the Impact for Your Restaurant Business posted first on happyhourspecialsyum.blogspot.com

Monday 16 April 2018

Navigating Online Comments and Reviews to Boost Customer Retention

Address negative online comments and reviews to bring back loyal customers.

It takes twice as much work to earn a new customer as it does to please an existing one, so don’t let one bad experience spell the end of a good customer relationship. If you think online reviews don’t matter, consider the fact that consumers now find a restaurant’s star rating to be the number one factor in choosing a place to dine, according to recent findings by socialmediaweek.org.

According to a Harvard Business Review Research Report by Michael Luca, for restaurants, a one-star increase in Yelp rating leads to a five-to-nine percent increase in revenue. So it’s clear that a restaurant’s online presence and reputation does in fact have an effect on its success.

Add to that the fact that 49 percent of consumers need to see at least a four-star rating before they choose to use a business, according to BrightLocal, and those reviews start looking pretty important.

If you’re thinking of letting customer reviews on Yelp, Facebook and Twitter slide while you manage the day-to-day of your business, you may not have a business left to manage after long. Here’s how to take control of your reviews, and possibly win over guests who leave negative comments and reviews.

Monitor Reviews Regularly

Social media monitoring programs now make it easier to track, post and reply to feedback that your business receives across a range of social channels. Check in with customer feedback daily and respond to the good and the bad promptly.

Don’t Hide from the Negative

You can’t please everyone, and it starts to look suspicious when your restaurant has received 100 five-star reviews. Embrace the constructive criticism and respond sincerely to those who have had a bad experience. Yes, it may have been easier if they approached you in the restaurant, but you still have a chance to show them, and others, how you’re able to step up and take care of the issue in a timely manner. Never put the blame on them by saying things such as, “You must have come in at a busy time.” Always accept blame and offer to rectify the situation quickly.

Show Them You’re Listening

When someone has posted an online complaint, it’s usually because they want—and expect—a response. A study by TNS Nipo of 2,000 social complaints showed 70 percent of complainants hoped to receive a response. Unfortunately, only 38 percent received a response. The study also revealed that the success of the response depended on three factors: the speed of the response; quality of the solution; and how well the business provided the human touch. Don’t let your online reviews go unanswered or you’ll quickly become the “owner who never responds to complaints.”

Address Individual Concerns

Since responding to a customer’s complaint online is likely to be the last chance you have to save the customer relationship, craft your reply carefully, while still keeping it brief. First, thank them for their feedback, and be specific about why they contacted you (e.g., “Thank you for contacting us about the long wait you experienced yesterday.”). Second, apologize and offer to make it up to them (e.g., “I apologize for the delay in receiving your meal and would love to make it up to you.”). Lastly, always provide an easy way for them to contact you off of social media (e.g., “Please contact me at your earliest convenience at xxxx@xxxx.com).

Statistics show an increase in visits and profits when business owners respond to online reviews, so keep a close watch on yours to prevent your loyal fans from turning into critics.

Navigating Online Comments and Reviews to Boost Customer Retention posted first on happyhourspecialsyum.blogspot.com

Food Traffic: Using IT and Big Data to Increase Sales

In today’s digital world the quantity of data being collected and stored on a global level is almost inconceivable and will only keep growing. Referred to as big data, organizations take advantage of this by analyzing the accumulated data for insights that lead to better decisions and strategic moves – making it a critical asset to countless businesses. The vast volume of structured and unstructured data at an organization’s disposal helps corporate America understand more about its consumers purchasing preference.

Big data is the most effective and beneficial loyalty program a restaurant has to generate a significantly lucrative advantage.

In the food service industry, big data can play a pivotal role in helping restaurants know customers on a deeper level, and as a direct result, open new revenue streams for increased sales and customer traffic. Using IT systems installed in restaurants, sizeable amounts of data can be gathered about customers’ habits and preferences. Restaurants’ IT and marketing teams can then absorb this data, notice trends and develop an action plan to increase sales.

Without realizing it, customers are creating a digital footprint of their preferences, habits and interests when they utilize a restaurant’s online resources, such as Wi-Fi, rewards programs and mobile applications. Restaurants can then use analytical software built into the aforementioned offerings to access data and define customer groups and personas. The more connected restaurant owners are with customers, the better they can cater to their needs and wants by offering tailored benefits, such as free food and in-store events.

In addition, exploring customers’ habits and preferences allows restaurants to have a predictive analysis advantage. By anticipating customers’ actions, you can build relationships with them on a new and personalized level. As a restaurant leverages predictive data to tailor its services, advertisements and other offerings, it is cultivating trust with customers as their relationship with the brand becomes more apparent. Essentially – big data is the most effective and beneficial loyalty program a restaurant has to generate a significantly lucrative advantage.