Modern Restaurant Management (MRM) magazine's "According to a recent study/survey …" column has been rebranded as MRM Research Roundup.

This time, we feature 2018 restaurant startup costs, fast food vs. fitness Google searches, Thanksgiving's Halo Effect and lots of food and beverage trends for 2019.

Positive Sales Trend Continues

Headlines continue to be encouraging for the industry, as chain restaurants posted their fifth consecutive month of positive same-store sales growth during October. This month’s sales growth rate of 0.8 percent does represent a slowdown from the 1.2 percent reported for September and the 1.8 percent for August, but there was a promising sign in October’s results. Same-store sales growth on a two-year basis was 1.1 percent during October. As a comparison, two-year sales growth rates averaged -0.9 percent for the previous six months. These insights come from TDn2K’s Black Box Intelligence™ data, based on weekly sales from over 30,000+ locations representing 170+ brands and nearly $71 billion in annual sales.

“As the industry heads into the fourth quarter, the fear was that tougher sales comparisons from Q4 of last year would throw restaurant sales back into negative growth territory”, said Victor Fernandez, vice president of insights and knowledge for TDn2K. “For reference, two out of the three months had positive sales growth during the fourth quarter of 2017. No other month of 2017 reported positive sales growth. But seeing restaurants grow their sales during October on top of positive sales growth during the comparable month a year ago suggests the industry’s sales momentum is robust and can carry into the new year.”

Less Guests But More Spending Fuels Sales Growth

Although positive sales growth is welcome news for restaurants, the way this growth was achieved during October tempers optimism in the strength of the industry by putting a spotlight on its problems. Same-store guest traffic was -2.2 percent in October, a 0.8 percentage point drop from the growth rate recorded for September. Furthermore, it was the weakest month for traffic growth since May.

An increase in average guest check year over year continues to fuel positive sales growth for restaurants. “Guest check growth accelerated in October,” said Fernandez. “At 3.0 percent, check growth during October was the highest we’ve seen in the last three years. Many brands have been raising their menu prices throughout the year, use of promotions to drive traffic may be slowing down and strong consumer confidence plus raising wages may be motivating consumers to spend a more when they dine out. Likely, we are seeing a combination of several or all of these factors.”

Consumer Spending Remains Robust, Sparking Hope For Strong Holiday Season

“The economy continues to expand strongly, but there are a few signs that the growth is moderating,” explained Joel Naroff, president of Naroff Economic Advisors and TDn2K economist. “The housing market is trending downward as mortgage rates and prices continue to climb. The trade battles have initially enlarged rather than shrunk the trade deficit. Business investment has been disappointing, given the surge in profits. But consumer spending remains robust and most importantly, wage gains are accelerating. That has offset the rise in prices.”

“While inflation-adjusted earnings are not soaring, they are growing fast enough to sustain solid household demand. Additionally, given the high level of consumer confidence, the holiday season should be very good,” continued Naroff. “That bodes well for restaurants. There is one significant concern, though: the savings rate is falling and, unless wage gains accelerate, the deterioration in spending power could cause households to cut back. The current draw down on savings is not sustainable. Expect demand to be good over the next six months, but by the spring, without better wage gains, consumers will probably become more restrained in their spending habits.”

Fast Casual and Casual Dining Continue to Find Success

Positive sales growth was widespread across most industry segments in October. All segments except for family dining achieved positive same-store sales growth.

The best performing segments based on sales growth were fast casual and casual dining. Both had growth rates above 1.0 percent in October. After having struggled through the last two years, these segments have emerged in 2018 as the most improved in terms of same-store sales performance. In fact they are the only segments with positive sales growth during each of the last five months.

Much discussion has centered around the viability of casual dining in this changing consumer landscape. However, the data shows some brands in the second largest segment within the industry have been able to turn the segment around this year.

Restaurant Staffing Pressures Intensify, Likely To Drive Rising Labor Costs

Over the last two years, restaurant operators have been citing staffing and employee retention among the biggest concerns they face. After a small relief from turnover rates that appeared to be stabilizing in recent months, turnover increased again during September for restaurant hourly employees and restaurant managers.

Additionally, restaurants need to keep up with replacing those employees that leave. TDn2K’s People Report data shows the number of jobs in chain restaurants grew by 1.7 percent during September, after a year-over-year growth of 2.1 percent during the previous month. According to People Report’s Q3 Workforce Index, 58 percent of restaurant companies plan to add hourly workers during the fourth quarter, while 51 percent said they plan to add management staff.

Not surprisingly given the environment, the latest People Report Workforce Index also revealed that about 70 percent of restaurant companies reported an increase in their staffing difficulties for both restaurant hourly employees and managers.

As the labor market experiences its lowest unemployment rates in almost fifty years, restaurants should be expecting rising labor costs ahead. With plenty of employment opportunities in the market, restaurant employees (particularly in management and back of the house) frequently mention pay among the main reasons they are quitting their jobs. Higher wages and salaries will have to be a part of many restaurants’ employment offerings if they are to remain competitive in the market.

'Gen Food' Trends

In a time when so many issues divide Americans, a group of consumers that crosses generations and demographics is shaping the future of food. A new report released by FleishmanHillard at The Culinary Institute of America's reThink Food conference shows, when it comes to food and nutrition, an emergence of shared beliefs and behaviors among Gen Z, Millennials, Gen X and Boomers.

"We call these cross-generational influencers 'Gen Food' because food defines them and is an important part of their values and belief system," said Jamie Greenheck, global managing director of FleishmanHillard's Food, Agriculture and Beverage practice. "They're taking personal responsibility for improving the way we eat and drink, which provides a tremendous opportunity for brands looking to connect and drive action through food."

The study of engaged consumers shows food unites more than it divides Gen Z, Millennials, Gen X and Boomers. Some highlights:

- 91 percent say food is an important part of their values and belief system.

- 35 percent say that food defines them.

- 79 percent feel it's their role and responsibility to share food information with others.

- 81 percent believe they can make a difference in the kinds of foods we eat and how they are grown.

- 78 percent have taken action to address food issues important to them – with reducing food waste emerging as their top priority.

- 60 percent say they bear the responsibility for improving what and how we eat – more than food companies, government entities or health professionals.

"The implications for food, agriculture and beverage companies are profound," said Greenheck. "Speaking Gen Food's language and understanding their values is important to having relevant conversations about everything from sustainable nutrition to agricultural practices and food waste. It's also vital to focus on the benefits of innovation as they become the primary drivers of food choice. Additionally, companies should make it easy for consumers to participate and contribute to a better, more responsible food system."

FleishmanHillard's Shaping the Future of Food study was conducted by its TRUE Global Intelligence practice, which conducted an online survey with 2,001 nutrition-forward consumers September 14-20, 2018, and evaluated drivers related to food, influences and behaviors. Respondents were screened for engagement on such factors as seeking information about food, sharing content about food and paying attention to ingredient lists.

Dishing About Lunch

Research from digital ordering technology provider Preoday and mobile payments and loyalty marketing platform Yoyo has found that value and speed are critical to delivering a successful workplace canteen experience, and that technology can help meet this demand.

When asked what is important during their lunch break, a third of workers with a workplace canteen (32 percent) say cheap prices and value for money is critical when buying food from their workplace canteen. Currently a similar proportion (28 percent) don’t believe they are getting enough value for money – nor are they being rewarded in any way for their regular custom at workplace canteens.

Over half of UK workers (57 percent) said the introduction of tech-led loyalty schemes that could offer more personalised deals would lead them to visit their workplace canteen more often. At present, only 15 percent of workplace canteens provide any sort of loyalty scheme to office workers.

Yoyo CEO Michael Rolph said that tech-led loyalty schemes can also put the right customer data into the hands of workplace caterers and open up a whole new world of personalisation. “Usually the closest lunch spots in proximity, workplace canteens have a duty to deliver an experience that will maximise both value and convenience for time-poor workers taking lunch.

“At the same time there is a huge opportunity for caterers to hone in on their customers’ behaviour, address gaps in their current services and deliver enhanced experiences that will increase footfall, bolster customer retention and, above all, strengthen revenue.”

When asked, almost a third (27 percent) of workers say “speed” is one of the two most important factors when considering their lunch options – and nearly a quarter (24 percent) said that queuing time actively puts them off visiting their workplace canteen.

Two fifths of UK workers (40 percent) also say they would visit their workplace canteen more often if the service was quicker or they could pre order their food and pick it up without queuing at all. However, at the moment, only 17 percent of workplace canteens offer a pre-ordering functionality to customers.

Nick Hucker, CEO of Preoday, said: “In the UK the desk is increasingly used as a dining table, but this is a trend that causes problems for employers and staff alike. While stress at work is often inevitable, it can be mitigated by taking a proper break. Without one, employees risk taking their stress home with them instead. The convenience of workplace canteens can provide this environment for a break and a good meal. Our report reveals that using technology to respond to demands for speed and convenience can both improve the lunch break experience and help canteens attract more custom.”

This report from Preoday and Yoyo reflects the anonymised responses of 2,003 workers based in the UK with a workplace canteen, surveyed between 12th – 19th September 2018. The survey was conducted by Opinium.

Restaurant Operating Costs

RestaurantOwner.com released the report of their 2018 Cost to Open a Restaurant Survey. The report summarizes input gathered from over 350 independent restaurant owners and operators regarding their startup costs as well as their financial performance.

A copy of the survey report is available here.

The median restaurant startup cost was $375,000. This equates to a median cost of $113 per square foot, or $3,586 per seat. Many factors affected cost including remodel vs. new construction, free standing building vs. tenant space, and whether the restaurant was full service, limited service, bar or tavern, catering business, or takeout and delivery.

"New construction was more costly than remodeling. The median cost of building a restaurant from the ground up, not including real estate, was $650,000," said COO Joe Erickson.

Remodeling a non-restaurant space was the second most costly, with a median cost of $425,500. Remodeling an existing restaurant space was the least costly, with a median cost of $275,500. Consequently, the median sales to investment ratio was highest for remodeling an existing restaurant space (4.2:1), versus either remodeling a non-restaurant space (2.1:1) or new construction (2.0:1).

The median size of restaurant startups was 3,070 square feet, and 120 seats. This size resulted in a median of 31 square feet per seat. Kitchens occupied about 31 percent of the restaurant space, with a median size of 1,000 square feet.

The median annual sales across all service types was $1.125 million. That financial performance resulted in a median annual revenue of $325 per square foot, or $10,567 per seat. Median time to profitability was 5 months. 25 percent of owners reported that their restaurant was profitable within the first 2 months and another 25 percent took 12 months to become profitable. The median net income reported was 5.5 percent.

Social Media, QSRs and Delivery

Despite expanded third-party delivery options like Postmates, QSRs continue to lead in brand loyalty, according to a new study by social media research firm Fizziology. To explain the current atmosphere among consumers and QSRs Fizziology completed a comprehensive report analyzing candid social posts on the topic of QSRs and delivery apps to explain the space.

Key takeaways include:

- QSRs were mentioned 1000 percent more than delivery apps: (Wendy’s, Chick-fil-a and Taco Bell) were mentioned 1044 percent more than delivery apps (Postmates, GrubHub, UberEats and DoorDash) combined

- Drive-thrus were mentioned 102 percent more than delivery options

- Pizza brands still lead the sports conversation:

While QSRs and delivery apps provide choices, pizza brands (Pizza Hut, Domino’s, Papa John’s) still lead the sports conversation with 572 percent more mentions than the top three QSRs (McDonald’s, Chick-fil-A, Subway) in September 2018

When it comes to quick service restaurants and delivery, consumers want to share their experiences with ordering and beyond on social media, showing how much these brands are part of their everyday lifestyles.

Through analyzing millions of consumer opinions across social platforms, Fizziology was able to identify emerging trends impacting quick service restaurants and delivery apps. As dining experiences continue to evolve it’s important for leaders in the restaurant space to adapt to the changes.

Fizziology analyzed Chick-fil-A, McDonald’s, Taco Bell and Wendy’s drive-thru and delivery conversation in September 2018. The QSRs are included in the top 10 fastest drive-thrus (QSR Magazine 4), but also offer delivery through third-party apps. Conversation surrounding a drive-thru was seen 102 percent more than delivery mentions. McDonald’s was the only brand to have more delivery mentions, which was due to its strong partnership with UberEats.

Chick-fil-A’s drive-thru drove 611 percent more mentions than delivery. Expanding delivery and catering is the QSR’s priority as its locations have six or more cars crowding the lane 40 percent of the time (QSR Magazine 5). While other brands are creating additional lanes and new digital menu boards, Chick-fil-A is piloting a new type of store entirely. Chick-fil-A’s new concept hyper-focuses on delivery and doesn’t offer a drive-thru or dining room.

As to-go orders grow in popularity, QSRs can strategize and implement concepts that may have been unconventional in the past. While QSRs need to refine and master the drive-thru experience, it’s important to also elevate delivery services to compete with QSRs like McDonald’s and Chick-fil-A that are leading in the space.

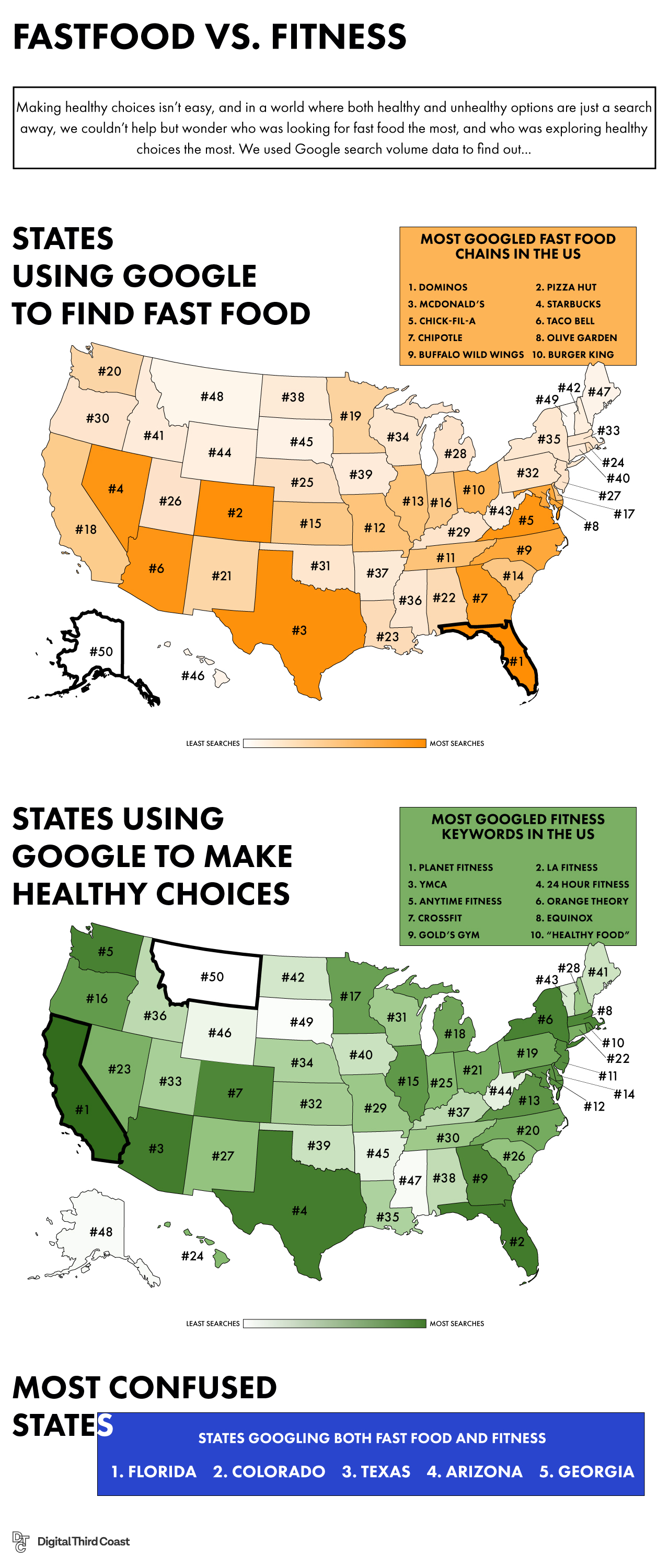

Fast Food or Fitness?

With National Fast Food Day on (November 16, Digital Third Coast wanted to see if Americans were more likely to search for fast food or fitness keywords.

To do this, they analyzed 2018 Google search data to identify the states most obsessed with fast food and the states most likely to make healthy choices with their diet.

The full analysis can be seen here.

Thanksgiving's Halo Effect

Betty Crocker is a CPG brand consumers have relied on to build out their Thanksgiving menus for decades. However, even though Betty Crocker has been historically linked to the holiday, data reveals they are far from the only CPG brand benefiting from the food shopping lead-up to Thanksgiving. Captify, the global search intelligence company, pulled this data.

Data reveals that Betty Crocker’s lead in Thanksgiving has created a halo effect for competing CPG brands. From October 1 – November 8, searches for Campbells increased by 197 percent and searches for Kraft increased by 165 percent. As anticipated, searches for Betty Crocker increased by 4973 percent during this same timeframe.

Low and behold – the facts show that Betty Crocker’s lead in Thanksgiving food shopping creates a moment for the Campbells and the Krafts of the industry to capitalize around the holiday, and in turn, reach consumers.

Retail Sales Up

Retail sales in October increased 0.4 percent over September on a seasonally adjusted basis and were up 5.6 percent year-over-year unadjusted, according to calculations released today by the National Retail Federation. The numbers exclude automobiles, gasoline stations and restaurants.

“Today’s pickup in retail sales shows a healthy pace of spending and a sign of ongoing consumer strength which is consistent with the state of the US economy,” NRF Chief Economist Jack Kleinhenz said. “The figures bolster expectations for the major shopping period of the year, the holidays. Thanks to a high level of consumer confidence surrounding the current and future economy, we expect spending to maintain its strong momentum.”

“The pickup in October was also due in part to delayed spending associated with the hurricanes in early fall,” Kleinhenz said.

October sales were up 4.3 percent on a three-month moving average compared with the same period a year ago.

NRF’s numbers are based on data from the U.S. Census Bureau, which released overall October sales – including automobiles, gasoline and restaurants – were up 0.8 percent seasonally adjusted from September and 4.6 percent above October 2017.

Food and beverage stores sales were up 3.7 percent unadjusted year-over-year and up 0.3 percent seasonally adjusted from September.

The October numbers come as retail continues a long-term pattern of increased sales. Total retail sales have grown year-over-year every month since November 2009, and retail sales as calculated by NRF – excluding automobiles, gasoline stations and restaurants— have increased year-over-year in all but one month since the beginning of 2010.

Fraud is a Major Concern

Three years after the switch to new chip-based credit and debit cards, a study released today by the National Retail Federation and Forrester says payment card fraud is still a top concern for large U.S. retailers as criminals move their activities online.

“The implementation of EMV chip cards and chip card readers was supposed to dramatically reduce credit and debit card fraud,” the State of Retail Payments report said. “So why is fraud still the top concern for merchants?”

The report found that fraud was the top payment-related challenge faced by retailers, cited by 55 percent of those surveyed. The reason is largely that Europay-MasterCard-Visa chip cards have moved payment card fraud away from stores and toward online transactions, the report said, citing a Forter study showing a 13 percent increase in online fraud last year. A Federal Reserve study said online fraud rose from $3.4 billion in 2015 – the first year retailers were required to accept chip cards or face an increase in fraud liability – to $4.6 billion in 2016 and was an “increasing concern.”

“In a post-EMV world, fraud is shifting from in-person to ecommerce channels, so retailers have been busy bolstering their defenses to mitigate the increasing costs and risks of ecommerce fraud,” the NRF/Forrester report said.

To help fight fraud, the report found that retailers want better authentication of purchases no matter where they take place and that 33 percent have implemented 3-D Secure, a system marketed as Verified by Visa or MasterCard SecureCode that is intended to help authenticate online purchases.

For in-person purchases, 51 percent of merchants said biometrics would be the best way to verify transactions, and 53 percent expressed interest in implementing forms such as the fingerprint and facial recognition available on smartphones. But with that technology limited to phones rather than cards, 46 percent said personal identification numbers would be the best currently available way to approve card transactions.

For purchases made with cards, 95 percent of retailers said requiring PINs would improve security and 92 percent would implement it if it were available. While EMV cards in other countries are chip-and-PIN, virtually all EMV credit cards issued by U.S. banks have been chip-and-signature with PIN available only on debit cards. And the major credit card companies stopped requiring a signature last year.

“The chip in an EMV card makes it very difficult to counterfeit the card, but it does nothing to show whether the person trying to use the card is the legitimate cardholder,” NRF Senior Vice President and General Counsel Stephanie Martz said. “If we want to stop card fraud, we need a better way of authenticating users and it should be one that’s affordable, easy and safe. Someday the answer might be biometrics or technology that has yet to be invented but, in the meantime, we know PIN can stop criminals dead in their tracks. With no signatures, no PIN and no biometrics, what we have right now is no authentication at all.”

NRF has long argued that PIN is important because the chip in EMV cards only prevents the use of counterfeit cards while not stopping lost or stolen cards, and a PIN can also provide a backup for cases where the chip malfunctions or is tampered with.

In addition to the focus on cards, retailers have also been installing technology to fight data breaches and thereby keep criminals from stealing card data that can then be used to commit fraud. The report found 89 percent expect to have tokenization in place by the end of next year, and that 80 percent plan to do the same with point-to-point encryption.

The second-biggest concern was the cost of accepting payment cards, including the swipe fees banks charge to process transactions, cited by 45 percent. While the survey found 49 percent of retailers have taken advantage of routing options required as part of a cap on debit card swipe fees passed by Congress in 2010, rising swipe fees for credit cards remain the subject of litigation between retailers and the card industry. Chargebacks of disputed purchases, which increased after implementation of EMV for some retailers, were the third-biggest concern, cited by 35 percent.

“Eliminating fraud and improving authentication are clearly top priorities for retailers,” Brendan Miller, principal analyst at Forrester, said. “As the answers to these challenges are found, the key will be finding ways to implement the solutions in a way that provides a frictionless experience for consumers.”

Feelings on Payment Technologies

TSYS conducted a study to understand how consumers feel about the payment technologies they encounter at restaurants. Of particular interest is a finding that one in five consumers have had a slow payment process incident ruin a dining experience. In fact, this is the most common payment experience to ruin a dining occasion.

Here are some hightlights:

- If a data breach occurred with a restaurant, 34 percent said they would not return (but 40 percent said they would)

- Mobile ordering is among the top conveniences that consumers desire; a combined 70 percent rank it first or second (that ties with the drive thru)

- Overall, 30 percent of consumers said a payment incident has ruined a dining experience (e.g., slow, lack of security, don’t accept payment method, etc.)

- Most consumers would prefer to pay at the table (48 percent) – especially millennials (72 percent)

- A restaurant’s payment technology is considered very or somewhat important by 58 percent of diners (69 percent of millennials)

- One third (32 percent) say they would reconsider dining at an establishment based on the payment technology they use

Menus of the Future

In its 6th annual Culinary Trends report, the Sterling-Rice Group (SRG), a research leader on trends in the food industry, identifies the top culinary trends that will stand out on menus, expand into grocery shelves and attract consumer interest in the year ahead.

The report identifies flavors, ingredients and even technological advancements in Artificial Intelligence and farming as components of the wave of dining and eating influences. It also cites a growing interest in food as a health, wellness and beauty partner. SRG's Culinary Trends Report for 2019 here was overseen by the agency's culinary director Liz Moskow and its culinary team who drew insights from over 175 food experts, sociologists, chefs, nutritionists, and other trend-spotters.

"The thread that ties all the new flavors, ingredients and market forces together is how our desire to improve all aspects of the human experience is profoundly influencing the foods we will be eating well into 2019," explains Liz Moskow, Culinary Director at SRG. "We are also seeing extreme diet protocols from keto to paleo and more, giving consumers permission to eat things that were previously considered bad for you. This gives full fat dairy and other foods a seat at the table."

SRG says to look for these culinary trends – and more – to expand and grow next year as they move from cutting edge to mainstream:

- Butter is the New Bacon – Fat Bombs are the new antidote to hunger and ketosis. And butter now appears on restaurant menus at an all-time high of 64 percent.

- Bitter is the New Sweet – Sugar aversion has given rise to bitter as the flavor of choice – menu references to bitter have risen more than 22 percent in the past four years and are projected to grow over 18 percent in the next four.

- Lettuce is going beyond the salad bowl and into fresh-pressed juice with exotic new varieties and hydroponically grown lettuces being called out by name on menus.

- Rooted and Ravishing – The plant-based revolution has taken hold with diners hungry for hearty veggie-centric main dish options with vegetables like cassava, Japanese yams, parsnips, jicama and even the classic white potato served up in delightful new forms.

- Data Mining Dining – Artificial Intelligence is the hot dish being served up in the food industry now. Technology is being leveraged to foresee food and flavor trends happening in real-time. Tech companies like Spoonshot, Foodpairing, Analytical Flavor Systems, and FlavorWiki are employing machine learning to support new product and menu development to pinpoint ever-changing consumer preferences as they happen.

"SRG has built its business on helping our clients leverage changing food and dining trends to bring fresh new offerings to their consumers," explained Cindy Judge, CEO of SRG. "With insights like these to help guide our innovation process, we have been able to deliver over $10 billion in new revenue to our clients over the past five years."

Discovery Diners

Targeting increasingly adventurous consumers, set on new discoveries and experiences, will be key to developments in the food and beverage industry in 2019. The connected world has led consumers of all ages to become more knowledgeable of other cultures, contributing to 35 percent growth of "discovery" claims, when comparing 2017 and 2016 new product launch numbers.

"Discovery: The Adventurous Consumer" leads the list of Innova Market Insights' Top Ten Trends for 2019. The company continuously analyzes global developments in food and beverage launch activity and consumer research to highlight the trends most likely to impact the industry over the coming year and beyond.

Innova Market Insights' top five trends for 2019 are:

Discovery: the Adventurous Consumer

The food and beverage industry is increasingly focusing on satisfying the adventurous consumer. Consumers are moving out of their comfort zones to explore bolder flavors and multisensory food experiences. There is a focus on heightened sensory delivery, often combined with an element of the unexpected.

The Plant Kingdom

The plant-based market shows no signs of slowing down. Companies and brands are greening up their portfolios to attract mainstream consumers who want to add more plant-based options into their diets. For many, going plant-based is about achieving a healthy and sustainable balance between meat and vegetables, rather than adopting an all-or-nothing way of eating.

Alternatives to All

As more consumers pay attention to health & sustainability, replacement foods and ingredients are on the rise. Health remains the number one reason to buy food alternatives, with one in two US consumers reporting that health is a reason for buying alternatives to bread, meat or dairy. The search for alternative proteins has resulted in a rising use of black beans, lentils, peas, rice, nuts & seeds, chickpea, and even insects, as protein ingredients for foods.

Green Appeal

The industry is increasingly committing to answering customer expectations around sustainability. This is driving corporate goals, as manufacturers commit to sustainable product and packaging development with a range of initiatives. This includes waste reduction through upcycled ingredients and post-consumer recycling, as well as improved biodegradability and new technology, such as compostable capsules and vegetable inks.

Snacking: the Definitive Occasion

For most consumers, snacking is a part of daily life and always has been. What is changing, however, is the way people think about snacking and what is considered a snack. Snacking is no longer the optional extra, but the definitive occasion. It is a central focus of innovation across all food and beverage categories, with 10 percent average annual growth of global food and beverage launches with a snacking claim over the past five years (CAGR 2013-2017).

Specialty Food Trendsetters

Plant-based foods, cannabis, and an ice cream renaissance top the list of 2019 trend predictions from the Specialty Food Association's Trendspotter Panel. Taking in influences from Millennials and Gen Z, and the often-overlooked Gen X, 2019 is setting up to be a year that takes the specialty food industry to new heights.

"The specialty food industry is growing rapidly, and much of this can be attributed to innovations happening in areas like sustainability, the plant-based movement, and desire for deeper regional flavors," said Denise Purcell, head of content for the Specialty Food Association. "The Trendspotters are seeing major shifts in how consumers are eating. These shifts are providing us with amazing options, along with the opportunity to change how we eat and how food is created. Old favorites like ice cream are being reinvented, while at the same time, we're seeing foods and flavors from around the world increasingly adapted into our everyday meals. It's an exciting time for specialty food, and we expect to see even more growth and innovation throughout 2019."

The Trendspotter Panel, comprised of professionals from diverse segments of the culinary world, have identified the following eight trends for 2019:

Plant-based blossoms into a movement. The plant-based groundswell has firmly established itself in consumer eating habits. Stretching beyond vegans and vegetarians, plant-based foods now hold broad appeal to consumers who are intrigued by health benefits and have concerns about how their food is sourced.

Makers are creating new product categories and disrupting old ones with plant-based options.

The movement will become situated in the larger context of sustainability : intertwined with upcycled products, as more companies turn to root-to-stem ingredients to combat food waste; snacks made from rescued bananas, or flours made with spent grains or pulp.

In addition to continuing product rollouts in snacks, and as dairy and protein alternatives, plant-based foods' rise across the foodservice sector will be significant in 2019.

Palates shift to regional cuisines of Africa, South Asia, and Latin America—driven by Millennials and Gen Z . Much has been said about younger generations' unprecedented exposure to global culture and cuisine from an early age. These consumers are adventurous and seek experience in their travel and in their food, which has led to a shift in interest to authentic regional fare.

African foods and ingredients from all over the continent are gaining notice, including fonio (West); nitter kbeh (East); ras el hanout (North); and biltong (South).

Regional South Asian cuisines are emerging and ayurvedic products—primarily whole or minimally processed foods—are on the radar.

Savory-sweet snacks in the street snack tradition will become more popular.

Expect to see new menus and packaged foods touting the regional flavors and ingredients of Mexico, Central, and South America, from heritage corn tortillas to the advent of mezcal as a spirit and an ingredient.

Cannabis across multiple categories . 2018 saw the emerging edibles segment gain a foothold in snacks and treats, as more states legalize sales of hemp-derived CBD products. Though the segment has its challenges as cannabis is still illegal at a federal level, consumer curiosity has been piqued. Factor in that a new generation is growing up in states where cannabis is legal, and signs point to future growth of the edibles market.

New products are rapidly hitting the market, many with high-end beautiful packaging and savvy marketing.

Look for more infused cooking oils, coffees, teas, chocolates, baked goods, snacks, and even beer and pasta to hit the market in the coming year .

Foodservice will continue to adopt cannabis cuisine menus and cocktails.

Packaging takes center stage—in the environment, and in consumer communication. Soliciting consumer trust through values conveyed on product packaging and, in some cases, the material of which it's made, will be more visible in the coming year.

As consumers increasingly placea premium on company values, producers are making their certifications and accreditations, such as B Corp, women-certified, and animal welfare, more prominent on packaging.

Sustainable packaging will grow, especially plant-based varieties. Expect to see some made of upcycled ingredients or scraps. Research is advancing the use of tomato peels, kelp, and mushrooms into sustainable alternatives, coatings, and other packaging materials.

Cassava. A specific star of the plant-based phenomenon is cassava, also known as yuca, a starchy tuberous root native to South America. Grain- and gluten-free, the cassava root is high in carbohydrates, but its leaves are a reported good source of protein and rich in lysine.

Cassava leaves have been especially evident in packaged snacks from cassava leaf chips to popped cassava and even a cassava leaf jerky.

While many products so far are packaged for retail, expect to see more cassava on foodservice menus as well in 2019, likely in baked goods or tortillas made with cassava flour.

Fermented functional beverages . Refrigerated ready to drink (RTD) functional beverages have grown 20 percent in retail sales, according to SFA's State of the Specialty Food Industry research. Probiotic-friendly kombucha has led the charge, and more fermented functional beverages touting health, tradition, and flavor are on the horizon.

Look for mushroom brews highlighting varieties like chaga, a nutrient-dense mushroom linked with antioxidants and cholesterol-lowering benefits; lion's mane, reported to have anxiety-reducing and heart-health benefits; and cordyceps, which may help with anti-aging as well as diabetes prevention and heart health.

Drinking vinegars, which are high in probiotics, amino acids, and antioxidants, will also continue to emerge.

Watch for kvas. This traditional Slavic and Baltic fermented grain beverage is commonly made from rye bread and flavored with fruits or herbs like mint.

Edible beauty . Noted as emerging by last year's Trendspotter panel, collagen is a full-fledged trend in 2019, and part of a bigger move to develop products that promote skin health and appearance.

Collagen is being infused into beverages, snack bars, and even wraps to help replace diminishing levels as consumers age.

Traditionally used topically, argan and almond oils are coming to market. Both oils are high in omega fatty acids and vitamin E which can help hydrate skin, restore elasticity, and reduce the visibility of wrinkles.

While marketed broadly, many of these products are targeted at the aging, and often overlooked, Gen Xers.

8. Ice cream renaissance . We all scream for ice cream, and now this traditional favorite is being rethought in function and flavor. Its reinvention started with dairy-free varieties made with coconut, almond, or soy milks. Then Halo Top entered the scene with its high-protein, low-calorie product that others are emulating. Now makers are blurring the lines between treat and healthy snack even further with some blending vegetables like cauliflower and carrots by into ice creams.

It's not all about health—boutique creameries known for local, hand-crafted, and indulgent ices creams are expanding nationally.

On the flavor front, global and floral notes like black sesame and jasmine are adding new touches to the market.

Look for innovations to continue to drive the category, including advances in the non-dairy segments.

The Specialty Food Association Trendspotter Panel

Polly Adema, PhD, director & associate professor, Master of Arts in Food Studies, University of the Pacific San Francisco Campus, San Francisco, CA

Melanie Zanoza Bartelme, global food analyst, Mintel, Chicago, IL

Ken Blanchette, QA director fresh depts., Center of Excellence, FreshDirect, Bronx, NY

Jonathan Deutsch, PhD, professor, culinary arts and food science, founder and director of The Drexel Food Lab, Drexel University, Philadelphia, PA

Kara Nielsen, vice president, Trends & Marketing, CCD Helmsman, Emeryville, CA

Melina Romero, manager, Trend Practice, CCD Helmsman, Emeryville, CA

Stan Sagner, writer and producer, NY, NY

Tu David Phu, chef, Oakland, CA

Kriti Sehgal, CEO, Pure Fare, Philadelphia, PA

Izabela Wojcik, director of house programming, James Beard Foundation, NY, NY

Whole Foods Trends

Whole Foods Market’s global buyers and experts revealed the most anticipated and innovative food trends for 2019 in their fourth annual trends predictions announcement. Pacific Rim flavors, eco-conscious packaging, faux meat snacks and new varieties of hemp-infused products are among the food influences expected to take off in the next year. The retailer’s seasoned trend-spotters thoughtfully compiled this report based on more than 100 years of combined experience in product sourcing, studying consumer preferences and participating in food and wellness industry exhibitions worldwide.

Whole Foods Market’s top 10 food trend predictions for 2019:

Pacific Rim Flavors

Flavor inspiration from the Pacific Rim (think Asia, Oceania and the western coasts of North and South America) are popping up in grocery stores and restaurants as people continue to explore more of the world through their palates. Ingredients like longganisa (a Filipino pork sausage), dried shrimp, cuttlefish and shrimp paste are on restaurant and home menus that span from breakfast to dinner, while vibrant tropical fruits such as guava, dragon fruit and passionfruit are making their way into colorful smoothie bowls and cocktails. Jackfruit is a popular meat alternative already being used in place of items like barbecue pulled pork, while an extract of monk fruit, an ultra-sweet-tasting fruit also known as luo han guo, can be used as a sweetener replacing added sugars. In the coming year, Whole Foods Market and 365 Everyday Value brands will launch a limited collection of refreshingly sweet products inspired by Pacific Rim fruits like guava tropical vinaigrette, pineapple passionfruit sparkling mineral water, mango pudding mix and passionfruit coconut frozen fruit bars.

Shelf-Stable Probiotics

Back in 2017, our experts predicted the naturally occurring probiotics in fermented foods like kimchi and “pickled everything” would blow up the food world. In 2019, expect even more innovative probiotic integrations in food — and not just in the supplement or refrigerated aisles. New strains of probiotics such as Bacillus coagulans GBI-30 and Bacillus coagulans MTCC 5856 are making more shelf-stable applications possible. Wellness-focused brands are making it easier to get more probiotics in your day by adding functional probiotic ingredients to your pantry staples through products like granola, oatmeal, nut butters, soups and nutrition bars. Another unexpected place shoppers can find probiotics is in the cleaning aisle with brands like Counter Culture Probiotic Cleaning Tonic, an all-purpose cleaner that utilizes probiotic cultures and essential oils. Even beauty brands are including pre- and probiotic-based ingredients through sunscreen and other topical body care.

Phat Fats

Fats are making a comeback, and the trendiest diets are on board. With the rising popularity of keto, paleo, grain-free and even “pegan” (paleo + vegan) diets, plus a general shifting consumer mindset, fats are starring ingredients in creative, convenient foods. Along with these phat fats, higher protein and lower-carb combos will continue to trend across simple and easy snacking categories. New integrations of fat sources — like keto-friendly nutrition bars crafted with MCT oil powder, coconut butter–filled chocolates, snacks affectionately called “fat bombs” and a new wave of ready-to-drink vegan coffee beverages inspired by butter coffees — are busting on the scene allowing consumers to get their fat fill with convenient treats. Keep your eyes and taste buds open for popcorn made with grass-fed ghee, multiple flavors of ghee that range from sweet to savory, plus new variations on traditional meaty snacks like chicken chips and thin, crisped beef jerky.

Next Level Hemp

Hemp hearts, seeds and oils are nothing new to food and body care lovers — they’re in everything from waffle mix to dried pastas. (Even baby hemp leaves have had their moment in the microgreens trends.) But a new interest in the potential benefits stemming from other parts of hemp plants has many brands looking to explore the booming cannabis biz. While CBD oil is still technically taboo (prohibited in food, body care and dietary supplements under federal law), retailers, culinary experts and consumers can’t miss the cannabis craze when visiting food industry trade shows, food innovators conferences or even local farmers markets. But there’s more to this trend than CBD. Andalou Naturals has introduced hemp plant stem cells in their CannaCell body care collection. Non-cannabis-derived sources from the endocannabinoid system (which are named after the cannabis plant that inspired their discovery), like phytocannabinoids that exist in nature, are also becoming more visible and prevalent due to the growing trend. It’s clear that hemp-derived products are going mainstream, if not by wide distribution, then by word of mouth!

Faux Meat Snacks

Eating more plants doesn’t mean you have to forgo beloved meaty flavors and textures. Plant-based foods will continue to surprise and inspire — this year taking on the meat-based snacking world of jerkies and pork rinds you may associate with the corner store and road trips. While plant-based foods aren’t exactly a new trend, our experts noted more people — even those who don’t eat only vegan or vegetarian — are exploring plant-based snacking as their palates crave adventure, want a break from meat or seek more ways to add savory umami flavors into snacks and meals. Mushrooms like king trumpet will play a key role here, flexing their flavor and texture powers in tasty jerky, “pork” rinds and “bacon” snacks (used in both Pig Øut Pigless Bacon Chips and Snacklins Cracklins Without the Pork) to offer up a satisfying crunch. Beyond these reinvented veggies and plant-based products, vegetarians can indulge in Quevos Egg White Chips for even more snacking.

Eco-Conscious Packaging

The number of brands making the switch to packaging with the environment in mind continues to grow at a quickening pace. Dozens of like-minded brands in the OSC2 Compostable Packaging Collaborative have pooled their efforts to make important advances in flexible product pouches. Some companies are making commitments to ban straws, while brands like Whole Foods Market are setting up regional pilots to test recyclable strawless, sipper lids made from PET, without increasing the plastic content of a lid/straw combination. Expect to see an emphasis on reusing, with more produce departments going “BYOVB” (bring your own vegetable bag) and traditionally single-use packages going multi-use, like multi-use (and compostable!) food wraps made from beeswax, as well as waxed canvas or silicone alternatives to the usual plastic storage bags that can be used for sandwiches and snacks. Some movements start as trends, then become necessities. This is one of them.

Trailblazing Frozen Treats

While there is something comforting and classic about a scoop of vanilla ice cream, some consumers are wanting something a little less, well, vanilla. The new pints on the block are adding a fresh take on a timeless treat with innovative bases like avocado, hummus, tahini and coconut water. Look down specialty frozen aisles and you might find plant-based frozen desserts like CocoWhip Soft Serve and ice creams with savory swirls of artisanal cheese (and don’t think you’ll stop seeing those low calorie, high protein players in the frozen aisle anytime soon). Globally-inspired frozen desserts are taking the stage — possibly sparked by 2018’s mochi ice cream obsession and a Thai rolled ice cream craze — with icy indulgences like airy Taiwanese snow ice and Mexican nieves de garrafa, not to mention stretchy, chewy, Turkish ice creams that get their unique texture from mastic and other unique sources. Popsicles and gelatos won’t be left out of the fun — they’ll get some buzz with boozier infusions coming to market.

Marine Munchies, Beyond Seaweed

Seaweed snacks rose to popularity a few years back and are now enjoyed by health-conscious adults and toddlers alike, however, our experts expect even more ocean influence in the grocery aisles in the year to come. Think beyond seaweed snacks. Sea greens are showing up in dishes like seaweed butter and kelp noodles while consumers are exploring new depths of ocean flavors with superfood properties like unique varietals of algae and kelp. Puffed snacks made from water lily seeds, plant-based tuna alternatives with algae ingredients, crispy snackable salmon skins with omega-3s and kelp jerkies are just a few testing the waters. A salty sea fennel and olive blend will debut on Whole Foods Market olive bars in 2019, and brands like Ocean’s Halo include kelp as an ingredient in all their miso and ramen broths, condiments and sauces.

Snack Time, Upgraded

Snacking across the board will take a turn toward the fancy, and snacks, as they start to usurp the usual three-meals-a-day routine, are anything but ordinary. Snacking has become an occasion of its very own — think charcuterie or cheese boards for one, one-ounce portions of Cypress Grove cheeses paired with demi-baguettes as desk snacks and more mini meals. More takes on snacking nod to the comforting treats of your second grade lunchbox, with better ingredients. Portable snack packages will feature bites like prosciutto and aged mozzarella, and artisanal versions of classic snacks like cheese or peanut butter cracker sandwiches. Ingredient-conscious snack and treat makers are creating new packaged snacks that take us back to our treat-loving childhoods but with higher quality ingredients, some of which are updated to accommodate special diets. Upgraded retro treats will star on 2019’s shelves — candy-coated Project 7 Organic Chewies burst with intense fruit flavor and are gluten free; Smashmallow’s marshmallow and puffed rice treats are gluten free and made with organic sugar; Little Secrets Crispy Wafers are long crunchy rectangles dipped in fair trade chocolate.

Purchases that Empower

Much like last year’s Transparency 2.0 trend, consumer purchasing power continues to motivate changes in the food, beverage and body care industries, as shoppers expect more from the brands and businesses they choose to support. In 2019, thoughtful consideration behind purchases moves beyond (but doesn’t exclude!) environmental stewardship and animal welfare, and becomes more people-focused. Greyston Bakery practices an open hiring model — no questions asked — to practice what they call “radical inclusion,” which includes anyone who has faced barriers to employment. Kuli Kuli produces moringa powder which is often grown and processed by women, and has provided more than $1.5 million in income to women-led farming cooperatives, nonprofits and family farmers around the world through their organic moringa supply chain. Whole Planet Foundation partners with suppliers such as Chobani, Frontier Co-op, Naked Juice, Wallaby Organic, Papyrus-Recycled Greetings and more to alleviate poverty through microcredit loans for the world’s poorest people — mostly women — who become empowered microentrepreneurs lifting themselves and their families out of poverty. Media outlets like Cherry Bombe Magazine make it easy to find and support women-owned businesses and female chefs in your community, while inspiring discussions on how to move the industry forward together. Contributing toward social movements via purchasing goods and services with missions you believe in can make for big changes that extend far beyond the world of retail.

This year’s predictions came from Whole Foods Market’s culinary experts and industry leaders who source items and lead trend-spotting initiatives across the retailer’s more than 490 stores. The in-house specialists combine their expertise from all departments including cheese, specialty, grocery, meat, seafood, prepared foods, produce and body care, when preparing the forward-looking trends report.

Mintel, the world’s leading market intelligence agency, has today (15 November 2018) announced three forward-looking trends which will lead the momentum of global food and drink innovation in 2019 and beyond.

2019 Global Food and Drink Trends

Looking ahead, Jodie Minotto, Research Manager, Mintel Food and Drink, Asia Pacific, discusses how issues of sustainability, health and wellness, and convenience will inspire formulation, packaging, marketing and more in the years to come:

“In 2019, support of and demand for more corporate sustainability programmes will grow as consumers better understand what’s required to get closer to achieving a truly circular food and drink economy. These sustainability efforts will include not only improving access to recycling, but creating products with ingredients that are grown in accordance to regenerative agriculture practices.

“Expect to also see food and drink manufacturers look to the beauty and personal care industry for inspiration for healthy ageing product development. More food and drink will address longevity-related health concerns, be marketed with positive language that rejects terms like ‘anti-ageing’ for its negative connotations, and appeal across ages.

“Finally, we predict the rising segment of consumers who are often on-the-go, yet want to spend more time at home will increase demand for upscale, ‘speed scratch’ solutions and restaurant-quality, ready- to-consume products. As meal kits and foodservice-inspired beverages lead the way, there will also be more opportunities for brands to develop healthy, flavourful, customisable, and quick premium convenience products for breakfast, lunch, dinner, snacks and dessert occasions.”

Evergreen Consumption

The definition of sustainability is extending to encompass the entire product lifecycle. From farm to retailer to fork to bin and, ideally, to rebirth as a new plant, ingredient, product or package, this 360-degree approach will ensure resources are kept in use for as long as possible. The movement towards circularity as the new sustainability will require collaboration between suppliers, manufacturers, governments, nonprofits, retailers and consumers.

A seismic shift in how consumers think about plastic is underway, with bio-based packaging materials set to be a key component to the next generation of responsible packaging. In 2019 and beyond, sustainability efforts will include not only improving access to recycling, but incentivising consumers to recycle packaging and offering upcycled goods. At the same time, efforts to improve air pollution, support plant welfare, restore soil health and embrace regenerative agriculture will emerge as crucial elements of holistic sustainability programmes that are important to companies and consumers alike.

Through the Ages

Preparing oneself for a longer, healthier lifespan is particularly relevant as consumers prioritise health and wellness as a holistic, proactive, and ongoing pursuit. Longer lifespans present significant opportunities for food and drink manufacturers to take inspiration from the beauty industry, which has successfully established a model for healthy ageing by designing proactive products that are marketed with positive language to people of all ages.

Specific to the world’s diverse senior populations, their needs can be addressed through food and drink for medical purposes, as well as products designed for prevention, with formulations that are nutritious, flavourful, and easy to consume. Yet as humans are living longer, more food and drink can be formulated to address concerns from people of all ages about bone, joint, brain and eye health as well as other age-related health concerns.

Elevated Convenience

From breakfast to dinner, a new generation of modern convenience food and drink is emerging as manufacturers respond to rising healthy eating priorities, quests for foodie-inspired flavours, interests in personalisation and competition from speedy delivery services. Looking ahead, a new wave of shortcuts will be available, offering new conveniences such as the expansion of individual meal kits sold at retail, foodservice-inspired packaged beverages, and a new generation of prepared meals, sides, and sauces that emulate the flavours and formats of restaurant meals.

Advancements in technology also will elevate the expectations of convenient food and drink options for consumers moving forward, from planning to shopping to preparation. Interest in premium convenience will not be limited to dinnertime, creating opportunities for every meal, snack, and beverage break.

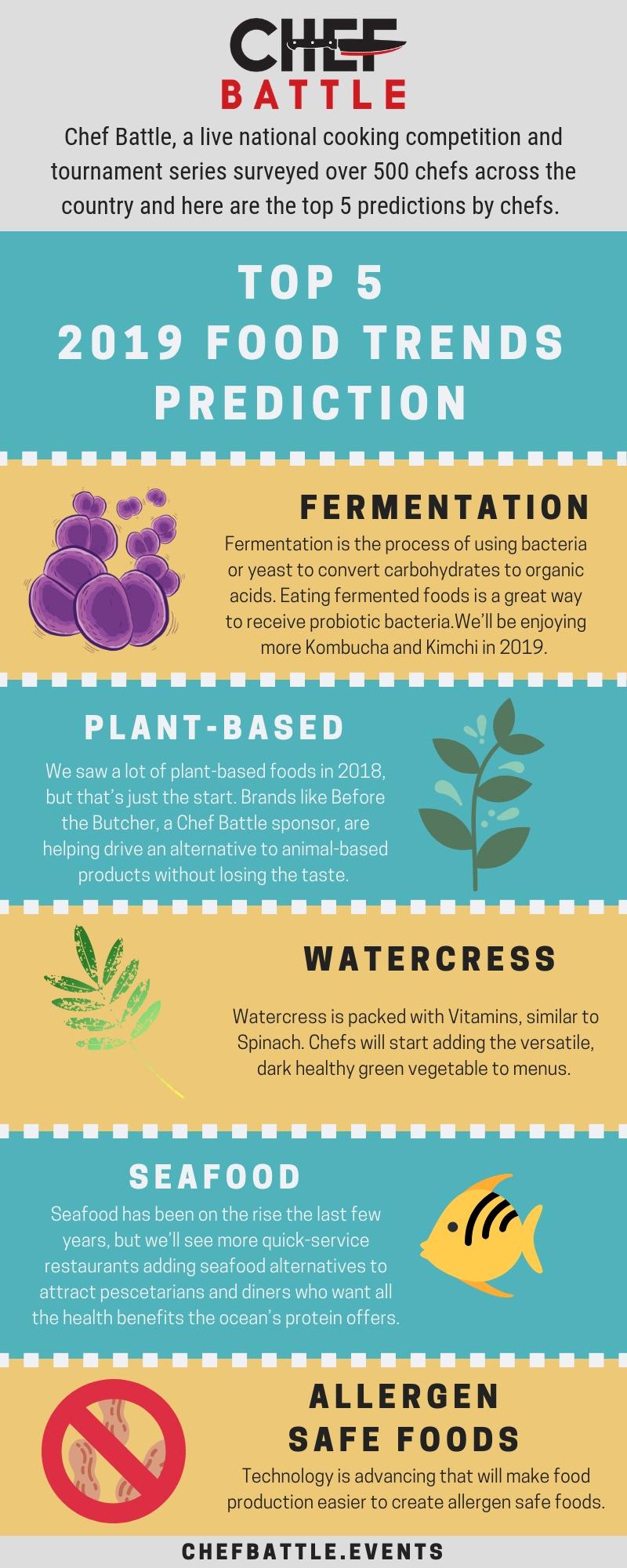

Chef Battle Predictions

Chef Battle, a national cooking competition tournament series produced by Social Power Hour, releases its 2019 food trends prediction after surveying over 500 chefs from around the United States.

Cannabis Takes Over

The future of cannabis in the food and beverage industries will be worth billions, according to the latest report from FUTURES – the new insights service from just-food and just-drinks.

Earlier this month, Michigan became the latest US state to give recreational cannabis use the greenlight, while Canada is expected to welcome cannabis food and drink products next year. Outside of North America, the drug is gaining acceptance and support.

The latest free report from FUTURES offers a detailed look at who the key players will be, where consumers will come from and what food and drinks companies need to do now to stay ahead in this nascent category.

Key findings in the report include:

Experts predict the cannabis market could be worth US$231bn in 15 years

From psychoactive ingredients to those that claim analgesic properties, cannabis will impact alcohol, health and wellness, consumer experiences and consumption occasions

Food and drinks companies will need to invest in expertise when it comes to creating products to suit myriad consumer needs

FUTURES editor Lucy Britner said: "Several large companies have already invested heavily in the cannabis space. The versatility of the drug means it will have far-reaching consumer appeal – and it will impact food and drink.

"This is the second in a series of future insights reports, designed to look at what will disrupt the food and drinks industries and offer insight into what businesses can start to do now."

FUTURES was launched in October 2018 by just-food & just-drinks' parent company Aroq. Starting with a series of digital magazines, the FUTURES service covers everything from new technologies to emerging consumer trends. The first edition was concerned with the growth of autonomous grocery delivery and how it is likely to impact the food and drinks industries.

Wine.com 100

Wine.com, the nation's leading online wine retailer, today announced the twelfth annual Wine.com 100. Reflecting the top wines purchased on the website during the first 10 months of 2018, the Wine.com 100 is the industry's only list based exclusively on consumer purchasing behavior. With nearly 35,000 unique vintage-specific wines purchased at Wine.com in 2018, the Top 100 is an exclusive group representing the best-selling available labels. The list provides insight into consumers' online wine-buying patterns, highlighting popular producers, regions and varietals. The complete 2018 Wine.com 100 list is available online here.

2018 Wine.com 100 highlights:

Washington State shines: This year, Substance 2016 Cabernet Sauvignon from Washington Statetopped our list. The list featured six Washington wines (up from 4 last year), two of which were in the top 10. This highlights the growing awareness of the state's value and quality combination, especially for red wine lovers.

Consistent quality vintage over vintage. This year 10 wines gained two spots on the list due to a vintage change. From Chardonnay to Rose to Cabernet, wineries like Caymus and Kendall-Jackson made double placements, reflecting the consumer's loyalty to specific wine year over year.

Rose all day. Following the national trend, rose claimed two more spots this year with a grand total of five. While not dominating the list, 5 percent is a big jump from the solo placement we saw in 2012.

"It goes without saying that I am super excited about Substance Cabernet being the number one wine at Wine.com this year," says Charles Smith, owner and winemaker. "Wine.com has done a great job of bringing forth Substance Cabernet Sauvignon so that the consumer can find out the great value and great quality the wine offers. I make it for you, I hope you like it."

"Our incredible assortment leads to customer discovery, from everyday wines to cellar-worthy collectibles. Offering wines from nearly every growing region on earth, our customers are able to explore the massive world of wine through our site," said Michael Osborn, Wine.com Founder and Executive Vice President. "With our unique Live Chat Sommelier Service, available 7 days/week, we provide real people with real wine knowledge to assist customers in navigating the vast selection and discovering the perfect wine for their needs."

The 10 most popular sellers on the Wine.com 100 this year:

1. Substance 2016 Cabernet Sauvignon (Washington State)

2. Kendall Jackson 2015 Vintner's Reserve Chardonnay (California)

3. Chateau de Landiras 2014 (France)

4. Delas 2016 Cotes du Rhone St. Esprit Rouge (France)

5. Veuve Clicquot Brut Yellow Label (France)

6. Meiomi 2016 Pinot Noir (California)

7. Borne of Fire 2016 Cabernet Sauvignon (Washington State)

8. Chateau d'Esclans 2017 Whispering Angel Rose (France)

9. La Marca Prosecco (Italy)

10. Kim Crawford 2017 Sauvignon Blanc (New Zealand)

Talking Turkey

Thanksgiving means turkey time for millions of Americans. The vast majority (88 percent) of Americans surveyed by the National Turkey Federation eat turkey on Thanksgiving. But make no mistake, turkey is no mere one holiday wonder. For instance, turkey is also a popular main course during Christmas and Easter celebrations.

Even beyond the holidays and special occasions, turkey has begun to take flight during everyday meals for many Americans, according to market research firm Packaged Facts in the report, Meat & Poultry: U.S. Retail Market Trends & Opportunities.

Packaged Facts estimates total retail dollar sales of the U.S. meat and poultry market at $95 billion. With sales of $27 billion, poultry—including chicken, turkey, duck, geese, and quail—accounts for 28 percent of the market. Between 2011 and 2016 sales of turkey products in the U.S. meat and poultry market had a compound annual growth rate (CAGR) of almost 8 percent.

"We've seen an uptick in turkey consumption volume as consumers increasing choose this product as a lean white meat alternative to chicken for non-holiday meals," says David Sprinkle, research director for Packaged Facts. "

Strong retail sales growth of turkey products is occurring amid a premiumization trend for refrigerated and frozen products, driven in part by the growing popularity of heritage, natural, and organic turkeys. Another factor supporting consumption growth is the increasing availability of turkey-based products that mimic their beef- or pork-based counterparts, such as turkey bacon, turkey burgers, and turkey sausages. Amid health warnings over the risks associated with red meats many consumers sought poultry-based versions of these foods, and turkey is generally more amenable to processing than chicken. The value-added nature of processed turkey products contributed to dollar sales growth.

Ad Personalization is Critical

Consumers expect ads to be relevant, according to a new survey by Clinch, a creative technology company that powers dynamic, personalized video advertising. The survey, which garnered insights from more than 500 U.S. consumers, found that 64 percent are comfortable with brands collecting some form of data – from demographic to social media profile information –to deliver a more relevant, personalized ad experience.

Although the technology is available for brands to leverage data to reach consumers in more personalized ways, many brands aren't tapping into this capability. When asked if consumers feel that ads on social media are personalized or tailored for them, less than a third (31 percent) said that ads are tailored to them the majority of the time (75 percent of the time or more). In addition, 35 percent indicated that they see the same ad too many times, a sign that brands aren't using the data being collected to their full advantage.

"Not recognizing the power of personalization is a big misstep among marketers," said Oz Etzioni, CEO, Clinch. "The data, creative tools and technology are available. Brands need to commit to building personalization-first strategies to create more meaningful consumer connections."

Social Media: A Key Personalization Platform

With rich consumer data and pioneering ad tools, it's no surprise that social media platforms are an effective personalization advertising channel.

When it comes to evaluating which social media platforms are most effective at reaching consumers, the majority of consumers cited that Facebook was most effective (79 percent), followed by Instagram (56 percent) and YouTube (47 percent). A third of consumers said that a combination of static and video ads on social media influenced them to make a purchase.

Etzioni explains, "Personalization needs to be pervasive across platforms and ad units. Unifying data and creative to create holistic campaigns is critical as consumers move through their digital lives consuming all different types of content throughout their day."

When it comes to social media, well-executed campaigns are increasingly driving direct sales. According to the survey, 70 percent of consumers have purchased a product or service after seeing an ad on social media. In fact, more than half (57 percent) purchased something in the past 12 months and, of those consumers, 60 percent have purchased between two and five products as a result of social media ads.

However, purchasing a product isn't the only action that consumers can take. After being exposed to an ad, 80 percent of consumers reported that they have used a search engine to find the product, and 61 percent indicated that they have visited a physical store location.

Etzioni concluded, "While there is no question that social ads are powerful, marketers must amp up their creative strategy. An effective social media video shouldn't feel like an ad at all. It should be personalized to the viewer and create an experience, rather than just deliver a sales message. Brands who follow this approach will not only see a direct sales lift, but they will also see increases in search and in-store traffic, as well."

Most-Promising Coffee Markets

Global market research company Euromonitor International released today a new study, “Five Most Promising Markets in Coffee”, identifying opportunities in both under-exploited and mature coffee markets. The new research provides a global overview of the coffee market and identifies Brazil, USA, Indonesia, Germany and Japan as the five markets with greatest potential.

Brazil

After surpassing the USA in 2014, Brazil became the largest coffee market in the world, representing 15 percent of global coffee sales in total volume. The country has shown steady growth during the economic recession, posting growth rate above the global average. While fresh ground coffee still dominates the market, the future of coffee in Brazil relies on new coffee types, such as beans and pods.

United States

The US presents a mature coffee market with growth rates below the global average in total volume sales. Despite ongoing concerns about sustainability, price and quality, coffee pods surpassed coffee beans and have become the second most prominent coffee format. The future of US coffee relies on premium and convenient offerings, while coffee shops and specialized stores are key drivers for this market.

Indonesia

With total volume sales reaching 735 thousand tonnes in 2018, coffee in Indonesia becomes increasingly relevant to consumers who seek to reproduce at home the foodservice experience. Growing urbanisation and more demanding lifestyles are driving consumers to opt for convenient products, and in coffee this is translating into higher demand for instant coffee mixes.

Germany

While one coffee format tends to dominate in the other four countries, coffee consumption in Germany is well proportioned, presenting opportunities for innovation and new brands. Sustainability and traceability, however, are more important factors in the purchasing decision as German consumers show interest in the entire coffee production and in having responsible consumption.

Japan

Coffee consumption is expected to be twice as large as tea consumption in Japan by 2022. Coffee beans is the most prominent format, representing 32 percent of total volume sales in 2018. On the other hand, sales of fresh ground coffee pods are expected to slow down due to the limited space in Japan’s households in urban areas.

Angelica Salado, senior analyst at Euromonitor International, commented, “companies sometimes wrongly believe that mature markets no longer offer opportunities for new players. However, coffee can present excellent opportunities for innovation in different channels, formats and claims, even in mature markets”.

Download a free extract of the study here.

Love for Animal Fats

“Fat is a necessary part of a diet.” “Animal fats are better for you than synthetic fat.” “Humans evolved to eat animal fats.”

So say respondents in the fourth annual Coast Packing Company/Ipsos Animal Fats Study, examining openness to, and consumption of, animal fats. Among the findings in this latest iteration of the consumer surveyfrom Ipsos Research and Coast, the number one supplier of animal fat shortenings in the Western United States: consumers recognize that not all fats are created equal or play an identical role in a balanced diet.

As in the original baseline study, conducted in November 2015, the 2018 edition polled 1,000 adults nationwide on their attitudes and consumption patterns around animal fats. Respondents were asked whether they were more or less open to animal fats, and whether those views extended to actual behavior. New this year was a question aimed at eliciting verbatim responses from a subset of the sample: “Why are you more open to animal fats in your diet?”

According to the study, more men than women are open to animal fats, a trend mirrored in their consumption patterns. Likewise, animal fat friendliness continues to be a function of age; millennials are both more open to animal fats in their diet and more likely to be consumers:

- Younger respondents are three times more open to animal fats than their elders (18 percent for 18-34 year-olds, compared to 6 percent for those ages 35+)

- Men are almost twice as open to animal fats (13 percent, to 7 percent for women)

- Americans with children in the household are significantly more open to animal fats (14 percent, compared to Americans without children in their household, at 8 percent)

- Consumption of animal fats among respondents ages 18-34 has increased by almost three times (at 14 percent) over that among Americans ages 35+ (at 5 percent)

- Consumption of animal fats by men has increased by almost three times (at 11 percent) the rate of consumption among women (at 4 percent)

- As with greater openness to animal fats, consumption of animal fats among Americans with children in their household has increased by a factor of nearly two (at 11 percent), compared to 6 percent among Americans without children at home

“As the latest Coast/Ipsos survey shows, consumers increasingly get it – they understand that animal fats are a net positive for health and well being,” said Eric R. Gustafson, CEO, Coast Packing. “We were especially pleased by the insights and thoughtfulness expressed in the verbatim responses. Today’s consumers clearly value authenticity and want food that is made with integrity and respect for culinary traditions. That’s whythe natural makeup of both lard and tallow matter so much. Neither contains the artificial trans fats found in hydrogenated shortenings. These products are best when minimally processed, which is consistent with the entire thrust of food and cooking right now.”

Healthy Eating

Consumers are increasingly taking on a more personalized, holistic view of health. They're making food and beverage choices based on their personal definition of health, such as food described as natural, organic, high in protein or functional (e.g., items to help boost energy or de-stress). However, the 2018 Healthy Eating Consumer Trend Report shows that despite abiding by these health definitions, consumers may still reconsider their restaurant orders if they think an item has too many calories. These views have implications for restaurants, especially as some restaurants are now required to post calorie counts and consumers increasingly rely on foodservice for meals.

"The foodservice landscape will become more competitive when it comes to tastier, more innovative healthy menu offerings," says Maia Chang, senior research analyst at Technomic. "This means that more brands will face additional pressure to differentiate through transparency and preparation techniques, as well as brand and sourcing stories."

Key takeaways from the report include:

- 40 percent of consumers say their definition of health has changed over the past two years

- 66 percent look for calorie counts on restaurant menus at least some of the time

- 34 percent say they'd be likely to order dishes made with vegetables, such as cauliflower pizza crust and zucchini noodles, instead of carb-rich items

Compiling findings from more than 1,500 consumer responses, as well as Ignite menu data on healthy item trends, the 2018 Healthy Eating Consumer Trend Report serves as a guide for foodservice operators and suppliers to discover the opportunities, challenges and consumer attitudes regarding healthy eating in the United States and the impact of those attitudes on foodservice use.

MRM Research Roundup: Mid-November 2018 Edition posted first on happyhourspecialsyum.blogspot.com

No comments:

Post a Comment